In this report, the Data Foundation describes the flaws with the federal government’s current document-based grant reporting system and envisions an open data future for the way grants are tracked and managed.

The federal government continues to rely on outdated, burdensome document-based forms to track $662.7 billion in annual grant dollars - but open data could transform the system. Adopting a government-wide open data structure for all the information grantees report would alleviate compliance burdens for the grantee community, provide instant insights for grantor agencies and Congress, and enable easy access to data for oversight, analytics, and program evaluation.

The report explains that the grant reporting system is broken, in two distinct ways: first, it does a poor job of delivering transparency to agencies, Congress, and taxpayers; and, second, grantees sustain unacceptable costs of compliance. Replacing documents with data could address both problems.

Contents

Introduction

The U.S. federal government awards more than $600 billion in grants each year1 to state agencies, local and tribal governments, and nonprofit organizations. To ensure grantees’ accountability for their use of taxpayers’ money, federal grants trigger a complex array of reporting requirements. These post-award reporting requirements are administered separately by thousands of programs, spread across dozens of grantor agencies, and governed by hundreds of different laws.

Federal grant reporting is broken in two distinct ways. First, it does a poor job of delivering transparency to agencies, Congress, and taxpayers. There is no central repository of all the information that grantees report to grantor agencies. There is no meaningful way to aggregate the entire government’s, or even an entire agency’s, grant reports to ensure compliance or compare performance.

Second, grantees sustain unacceptable compliance costs. Grantees must fill out reporting forms, often providing the same information multiple times, in an atmosphere of uncertainty and arcanity.

Most grant reports are documents: grantees must compile and submit forms to apply for, receive, and report back on their grant awards. Even where grant information is submitted electronically, electronic submission tools still typically rely on plain-text fields based on the paper documents that they recently replaced.

Federal grant reporting is outdated when compared with other areas of government reporting. Around the world, governments are choosing to transform document-based regulatory reporting into open data, in which all information is expressed using standardized data fields and formats. Open data can be instantly aggregated for transparency and accountability. Open data can often be compiled automatically, with software pulling the needed information from internal systems.

By replacing document-based regulatory forms with open data, the government of Australia saves Australian companies over $1 billion annually, because the companies’ software can automatically generate and submit regulatory reports to multiple government agencies at once.

In the United States, the open data movement has recently begun to transform the way that federal agencies report their spending. The Digital Accountability and Transparency Act of 2014 (DATA Act) requires the entire federal executive branch to begin a shift from document-based financial and award reporting to a system of open data, using government-wide data fields and formats. Federal agencies began reporting standardized spending data to

a central repository housed within the Treasury Department on May 9, 2017. The DATA Act has created a single, unified open data set that represents the whole government’s spending, delivering instant information to agency leaders, Congress, and taxpayers, while also enabling software to automatically report and validate spending information.

Open data can deliver the same transformation in federal grant reporting as has already begun in Australian regulatory reporting and U.S. agencies’ financial reporting. If the federal government adopts a standardized data structure of common data fields and formats, applies that structure to all of the reports that grantees must file, and publishes all of this information as open data, then the central problems of grant reporting can be solved.

The foundation for open data in grant reporting already exists. The Department of Health and Human Services has created a dictionary of data fields, known as the Common Data Element Repository Library (CDER Library), that could be expanded into the necessary government-wide data structure. But to allow information to flow freely to government and taxpayers, and to reduce grantees’ compliance costs, the government must expand that dictionary, support its use, and, ultimately, require all grant programs to conform their information collections to it.

This paper describes the current state of federal grant reporting, explains the promise of open data to improve information delivery and reduce compliance costs, recounts the relevant history of federal grant policy change, and envisions an open data future for grant reporting.

Assessing Post-Award Grant Reporting

Post-award grant reporting is document-based – which makes the system, taken as a whole, more complex, more costly, and more impenetrable than it should be.

Every federal grantee must sign a grant agreement, which legally compels it to fulfill a variety of administrative requirements, including grant reporting.2

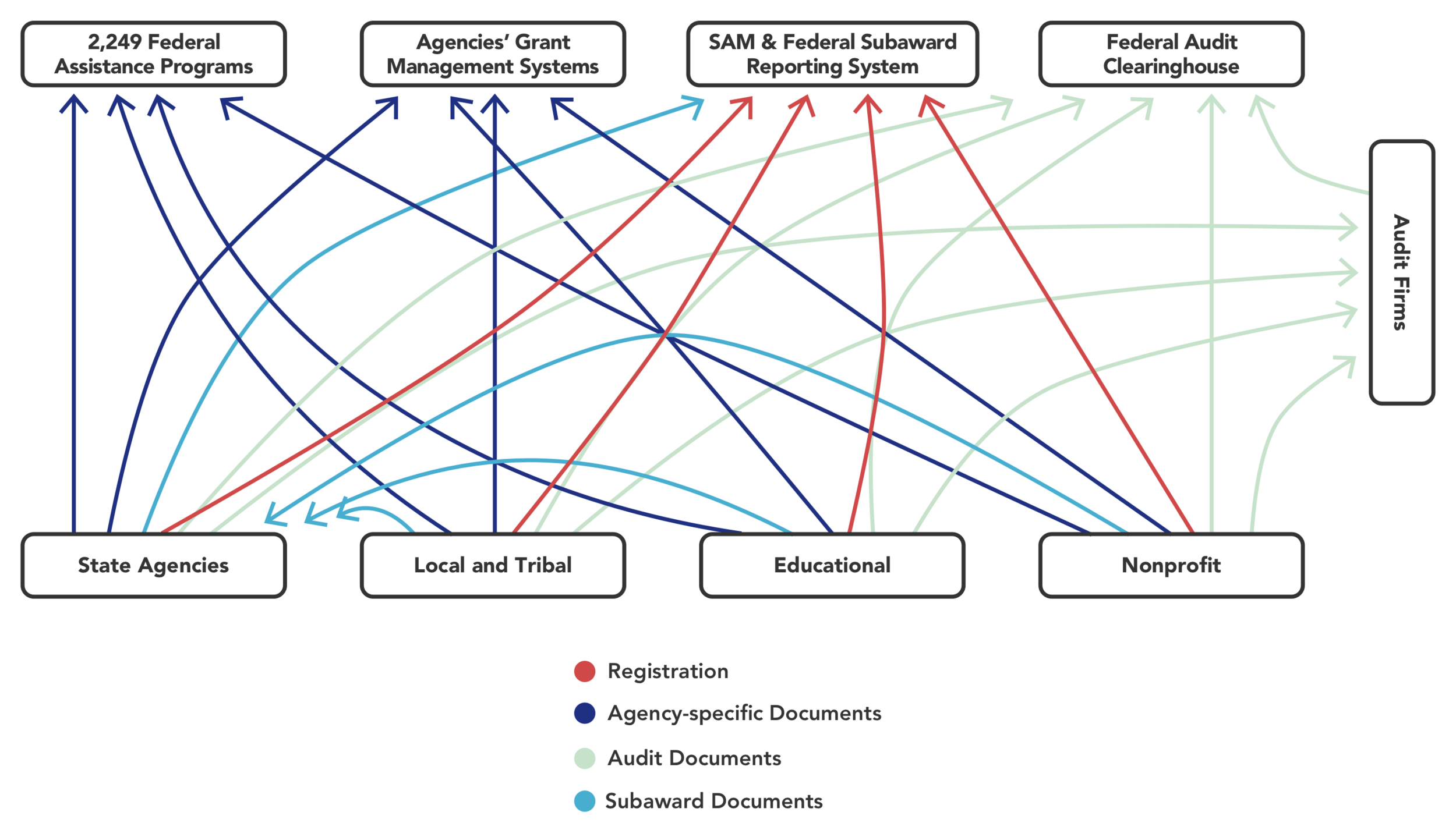

Grant reporting can be divided into four main categories: agency-specific reporting, registration, subaward reporting, and Single Audit reporting. First, agencies impose their own reporting requirements for each grant program, often reflecting the unique requirements of the different laws governing each program. Agency-specific reporting requirements are sometimes further divided between performance reporting and financial reporting. In some cases, grantees report performance details to a program office and report financial details somewhere else, such as an agency-wide grant management system. Agency- specific reporting is governed by the Uniform Grant Guidance, issued by the White House Office of Management and Budget (OMB).3

Second, all grantees must register with the System for Award Management (SAM), which is maintained by the General Services Administration. Third, prime grantees – those using federal grant funds to award sub-grants to sub-grantees – must report on their sub-grants to the Federal Subaward Reporting System, which is part of SAM.4 Forth, under the Single Audit Act, all grantees receiving more than a prescribed total in federal grants must undergo a combined audit, and report their audit results to the Federal Audit Clearinghouse, which is maintained by the Census Bureau on behalf of OMB.5 The current state of post- award grant reporting is summarized in Infographic 1.

The Diversity of Federal Grantmaking

In fiscal year 2017, the federal government made $662.7 billion in grant awards,6 funding nearly 2,300 grantmaking programs at 70 agencies.7 Mandatory health spending made up a majority of these expenditures. The remainder, about $277.6 billion, still represented more than 7% of the total federal budget.

Federal grants fund a wide variety of priorities – everything from environmental mitigation, income security programs, and early childhood education to transportation projects, community redevelopment, job training, and social services. While grants are often thought of as the purview of either the Department of Health and Human Services (HHS), the arts, or research, there is no federal department that does not contain at least one of the more than 70 federal grantor agencies.

The multiplicity and diversity of grantor agencies and grantmaking programs, all governed by hundreds of different laws, makes it difficult to comprehend the federal grant ecosystem system as one unified whole. Department of Transportation grants for infrastructure improvements have very different goals, stakeholders, and governing laws from grants for body armor administered by the Department of Justice. And these have very little in common with National Institutes of Health research grants to study disease or U.S. Agency for International Development grants build entrepreneurial capacity in foreign countries.

Even within departments, the goals of their grantmaking programs can vary widely. For example, Federal Emergency Management Agency (FEMA) emergency grants have very little in common with Science and Technology Directorate research grants, even though both originate within the Department of Homeland Security (DHS). Within Departments, separate Offices and Agencies each have their own administrations, priorities, and portfolios, and often their own technology, software, and systems, award grants. Frequently, their grant systems and processes were designed piecemeal, and for particular purposes, often not fully integrating into those of their larger organization, and creating significant siloes and challenging structural impediments.

Beyond the varied systems and capacities of the grantor agencies, there are also different grant agreement categories, including multi-year, renewal, extension, and cooperative, each carrying different reporting requirements and any or all of which may be in use by a given grantor. Moreover, each individual grant program can come laden with its own terminology - one which further complicates the already fractured vocabulary used between budget activities and financial reporting. An internal survey of terminology used in grant reports at HHS alone uncovered eight distinct definitions of a congressional district,8 and this is by no means a unique problem.

The Complexity of Post-award Grant Reporting

The diversity of federal grantmaking creates complexity in grant reporting. States, local and tribal governments, universities, and large nonprofits often receive grants from many different grantmaking programs, each with its own administrative and reporting requirements.

Most federal grant reporting takes place by means of document-based forms, usually completed and submitted in the PDF format. Some agencies have created grant management systems that allow grantees to submit information using web forms and similar means. However, these systems still mimic the document-based forms that they replaced.

The White House OMB has promulgated a few government-wide forms to standardize the content of the financial information that agencies’ grant program offices collect from their grantees. The most important of these is SF-425, the Federal Financial Report.9 However, even the basic financial details of SF-425 are not consistently collected. Grantmaking program offices “often exempt grant recipients from having to submit certain data elements ... [and] financial reporting varies across agencies and programs, with the reporting cycles ranging from quarterly, to semi-annually, annually, biennially, and some only at award closeout.”10 Outside basic financial details, the “incongruent nature of federal grant reporting leads to duplicative systems, data inconsistencies, and administrative burdens for recipients and agencies.”11

Overlap between the agency-specific reporting requirements and the other categories – SAM and the Federal Audit Clearinghouse – further contributes to the complexity facing grantees. Even if a grantee has already submitted financial information to the specific agency and program office administering a particular grant, it often must again submit the same information to SAM and to the Federal Audit Clearinghouse.

In addition to their overlapping complexity, reporting requirements are often poorly-defined. A survey of grant reporting forms used by the Department of Health and Human Services showed that approximately 90% did not define their terms or specifically describe their fields. For example, most forms did not specify whether a date should be expressed numerically (12/24/1942) or written out (December 24th, 1942).

Infographic 1: Current State of Post-Award Grant Reporting (Simplified)

Consequences of Complexity

The document-centric nature and the substantive complexity of federal grant reporting impose burdens on grantees and create challenges for federal oversight by agencies and Congress.

The burdens on grantees are widely recognized. In August 2017, a White House OMB report recognized:

years of frustration expressed generally by the Federal agency and [grant] recipient community over the lack of data standardization and burden associated with reporting information to Federal awarding agencies. This burden is especially apparent to recipients of multiple Federal awards who report that they are often providing the same or very similar information to multiple Federal agencies or components within the same agency and that this data is provided through several different interfaces. Similarly, Federal awarding agencies report that there is no government-wide solution allowing agencies to share award level information (including performance) and that there is no standard business process that could be leveraged to support this effort. Agencies report that they are limited in standardization efforts due to conflicting statutory and/or regulatory requirements associated with financial assistance awards.15

Grantees of all types – states, local and tribal governments, universities, and nonprofits – suffer from these problems. In April 2017, for instance, the Government Accountability Office (GAO) addressed the complexity of grant reporting by including it as one of fifteen focus areas in its annual report on “fragmentation, overlap, or duplication” in government programs.16 Focusing specifically on research grants, GAO found:

Universities commonly receive grants from multiple agencies, and have to design and implement multiple processes and may need to invest in electronic systems to comply with agencies’ requirements, and researchers and administrative staff must spend time learning the different requirements, processes, and systems.17

A 2013 Urban Institute survey of nonprofit organizations receiving federal grants found that 70% of respondents worked with multiple grantor agencies, while 71% of the surveyed organizations defined the complexity of their required reporting and the time necessary to complete it as problematic.18

State agencies struggle with these issues as much as other grantees do, and with an added twist: they are both federal grantees and organizational grantors in their own right. State agencies’ program administrators must ensure not only their own compliance with reporting requirements but their subgrantees’ as well. And they must aggregate information they receive from their subgrantees into their own reporting to the federal government, all while maintaining compliance with their state’s individual statutory requirements.

The complexity of federal grant reporting also prevents managers and policymakers from easy access to the information they need. Because “there is no government-wide solution allowing agencies to share award level information (including performance) and that ... no standard business process that could be leveraged to support this effort,”19 federal agencies and Congress cannot easily aggregate or compare details on grant programs’ or individual grantees’ performance.20

Moreover, the majority of grant reporting forms, including the commonly-used SF-424 and -425 for Federal Financial Reporting, are mostly transmitted from grantees to grantmaking program offices as static PDF documents. Static PDF forms cannot feed directly into searchable databases. Information must be extracted and translated into searchable data before it can be aggregated. Each such extraction and translation becomes a separate, freestanding project.

The vague definitions of federal grant reporting forms further contribute to grantees’ burden and grantors’ challenges. When the specific information requested by a particular blank on a grant reporting form is unclear, grantees face risk responding to it. Within individual federal programs or offices that directly fund activities, the lack of definition or prescribed formatting may not be a pressing problem, as each office or agency presumably knows what they mean by the terms in their own forms and can communicate those needs directly to the grantee performing the work. But at higher levels of aggregation, across program offices, agency-wide, or government-wide, grantor agencies and Congress cannot draw meaningful conclusions.

With high compliance costs burdening grantees and major challenges facing agencies and Congress in their oversight, widespread cynicism about the benefits of grant reporting has emerged. Many grantees view compliance as little more than a necessary evil: it is annoying, frustrating, and provides no return on investment beyond not disqualifying themselves from the next funding cycle. Duplicative and vague reporting requirements are bad enough for grantees, but the perception that grantor agencies do not do anything with the information that they receive adds a significant element of understandable frustration. From the grantees’ perspective, the information they compile and report disappears once it has been delivered to a grantor agency. It must be re-entered in the next funding cycle; it does not automatically appear in other agencies’, or even other programs’, reporting systems; and the lack of structure makes it extremely difficult for grantees to leverage the data themselves.

The compliance burdens shouldered by grantees and the transparency challenges faced by grantors share one ubiquitous common cause: from compliance culture to duplicative burden, and from unreliable baselining to unspent grant funds, all roads lead back to disorganized data.

Envisioning an Open Data Structure for Grant Reporting

Infographic 2: Future State of Post-Award Grant Reporting

Previous attempts to address the overlapping complexity and vagueness of federal grant reporting have focused on aligning the substantive information grantees must report to different agencies or program offices.21 These attempts have failed, defeated by the multiplicity of agencies issuing grants, the organizations receiving them, and the laws governing them.22

But data technologies are now ready to address the inherent problems of the current system of federal grant reporting, to the benefit of grantees, grantors, and the public. By adopting a government-wide open data structure for all the information grantees report, the federal government can reduce burdens on grantees, enable grantor agencies and Congress easy access to data for oversight, and improve the whole system to the benefit of all its constituents. In other words, the federal government should replace document-based forms with standardized, open data.

This recommendation is very different from forcing agencies to adopt the same forms, or the same substantive reporting requirements, across their diverse programs. An open data structure could accommodate all manner of disparate reporting requirements, preserving necessary diversity while still allowing software to deliver the right data to the right recipients.

Benefits of an Open Data Structure

A government-wide open data structure covering all the information grantees must report will facilitate the automated compilation and submission of such information while enabling cross-program and cross-agency transparency for grantor agencies, Congress, and the public. As a result, an open data structure will reduce grantees’ burden, resolve agencies’ and Congress’ oversight challenges, and thereby benefit all the constituencies served by federal grants.

First, data standardization will allow grantees’ software to automatically compile and submit reports. Financial reporting requirements typically call for information that can be extracted from grantees’ financial systems – but because such requirements are expressed as unstructured blanks in document- based forms, rather than as well-defined electronic data fields, software vendors are unable to build systems that can reliably compile the exact financial information that is required.

Performance and programmatic information might be less likely to already reside in grantees’ systems. Never-the-less, if data fields are standardized consistently across multiple agencies’ and programs’ reporting requirements, once a particular data field is reported software will be able to automatically fill in the same field in all other instances where it is required. For example, if a grantee providing a school lunch program must report the number of students who qualify for assistance over a particular time period, data standardization will allow software to automatically populate that field for every grant using the same qualifications once this information is reported for the first time. In this case, automation could be used to identify additional programs these students qualify for but from which they are not currently receiving services, giving the grantee the opportunity to improve outcomes through better insights.

Automating grant reporting will not only reduce grantees’ costs and allow analytics for program improvements. By removing human data entry and imposing machine validation, automation will also improve the quality of the information grantees submit, reinforcing their accountability and avoiding manual corrections.

Second, an open data structure will allow the federal government to create a single, unified data set covering all grant reporting, bringing cross-program and cross-agency accountability. Program managers in the federal government’s nearly 2,300 grantmaking programs currently have no means of systematically aggregating an individual grantee’s reports to other programs to produce a full picture of their activities – even though such information is usually legally public, often already publicly available (though spread across multiple sources in disparate formats), and would be disclosed in response to targeted, piecemeal Freedom of Information Act (FOIA) requests. A unified data set will make data sharing among program offices simple, automatic, and ubiquitous, thus providing systemic insights on how programs are run, how grant dollars are allocated, how grantees perform, and how funding leads to outcomes.

An open data structure will improve grantor agencies’ workflow in other ways as well. Today’s document- based system requires agencies to spend time designing, maintaining, and seeking White House approval for reporting forms.23 With an open data structure expressing – as data fields and formats – the concepts that grantees must report, the intervals of reporting, and the authorities under which the information must be reported, agencies will be able, instead, to create customized reports from grant information, according to need.

Describing an Open Data Structure

A government-wide open data structure for grant reporting should be specific, mandatory, nonproprietary, as comprehensive as possible, and governed for the long term.

First, an open data structure should predictably specify the fields and formats of federal grant reporting, in a manner predictable enough for software to rely on it. Data elements should have precise definitions: unambiguous, simple, and independent of other elements’ definitions.24 Data formats should clearly identify which data elements must be reported for which purposes and how they relate to one another, permitting automatic validation. For instance, a government-wide data structure for grant reporting would include a format for annual financial reports specifying that all of the different expense categories pertaining to a particular grant must add up to a bottom-line total – allowing software to automatically reject submissions with incorrect math. To the extent practicable, data formats should also specify when information is to be reported, and under what statutory or regulatory authority.

If properly designed, a government-wide data structure will remain independent of the systems used by grantees to compile and report their information, and of the systems used by agencies to receive, validate, and analyze that information. Therefore, although imposing a government-wide data structure might require agencies to upgrade their existing grant management systems, it would not force wholesale replacement nor result in a software monopoly or reduce an agency’s ability to select solutions which best meet their individual needs.

Second, an open data structure should be mandatory. Grantmaking programs must be required to collect information from their grantees using the data structure, and in no other manner. Program offices should be free, of course, to use web forms, electronic uploads, distributed ledgers, cloud-based management software, or any other technologies to collect grant reporting information, so long as those technologies embed, and enforce, the data structure. Moreover, a data structure need not be made mandatory immediately, or all at once. Instead, it could be phased in over a period of years. Financial information could be standardized before programmatic or performance information. A preliminary period of optional, voluntary standardized reporting could be used. However, all stakeholders should understand that the structure will eventually be fully mandatory.

Third, an open data structure should be entirely nonproprietary, and published for the free use of federal agencies, grantees, software vendors, analytics solutions, and transparency platforms. The GAO has reported on the federal government’s efforts to find alternatives to proprietary recipient identifiers, for example.25 If data fields or formats are proprietary, the information cannot be freely downloaded or exchanged.26 A government-wide data structure for grant reporting should utilize a nonproprietary identification code for all grantees, and should avoid the use of any other fields or formats with similar restrictions.

Fourth, an open data structure should be as comprehensive as possible. Financial information has already undergone some substantive government-wide alignment, and therefore might be prioritized first, but programmatic and performance information should be standardized, too, wherever possible. Grantees and grantor agencies should have confidence that the data structure expresses all relevant reporting requirements, and be able to trust software built on that structure.

Fifth, a government-wide data structure should have permanent governance, with no danger that policy or vendor changes might affect availability.

Precendents for an Open Data Structure

In adopting a government-wide open data structure for all grant reporting, the federal government will have at least two compelling precedents to follow.

First, Australia and other countries have adopted open data structures for regulatory reporting by private- sector companies, a concept called Standard Business Reporting (SBR).27 SBR involves the adoption of a government-wide data structure, also known as a data taxonomy, for information reported by companies to multiple regulatory agencies. For example, the Australian taxonomy standardizes information that Australian companies must report to the national tax agency, state tax authorities, work force authorities, retirement funds, and the securities regulator. Software vendors have created products that allow Australian companies to automatically compile and submit all of these different government reports automatically, within the same software environment. The Australian SBR program was saving Australian companies over $1 billion per year by the 2014-15 fiscal year by replacing manual reporting activities with

automatic reporting.28 The Australian SBR program also saves hundreds of millions of dollars for government agencies by eliminating manual processing of regulatory reports.29 Although grant reporting differs from regulatory reporting, the U.S. government can expect similar benefits from a government- wide data taxonomy for grant reporting: reduced burdens for grantees and better information availability for the grantors and watchdogs.

Second, the U.S. government has already adopted a government-wide open data structure for spending information reported by the federal agencies themselves. Under the Digital Accountability and Transparency Act of 2014 (DATA Act),30 the Treasury Department created a data structure standardizing federal agencies’ financial account balances reported to Treasury, budget information reported to OMB, and award information reported to the General Services Administration. Starting in May 2017, every federal agency began reporting standardized spending information in a format consistent with the government-wide data structure, which is called the DATA Act Information Model Schema, or DAIMS.31 Treasury aggregated all of these submissions of standardized data to create the government’s first unified data set of all executive-branch spending.32 For federal agencies subject to spending reporting requirements, the DATA Act’s government-wide data structure facilitates automated validations.33 For recipients and users of federal spending information – financial officers, the White House, Congress, watchdogs, and taxpayers – the government-wide data structure creates new management and transparency tools.34

The two contexts in which open data structures have been successfully implemented government-wide – foreign regulatory reporting and federal public-sector spending reporting – are similar to the federal grant ecosystem in key ways. First, like federal grants, Australian regulation and U.S. public-sector spending both require the same entity to report overlapping information to multiple recipients: an Australian company must file overlapping reports with tax, labor, and securities agencies, while U.S. federal agencies must report overlapping spending information to Treasury, the White House, and the GSA. In other words, Australian regulation, U.S. public sector spending, and U.S. federal grant reporting are all multipolar reporting regimes. Second, Australian regulation and U.S. public-sector spending are governed by multiple laws, just as the federal grant ecosystem is, and a government-wide data structure could only be imposed and implemented with a government-wide mandate and leadership.

To determine how, practically, an open data structure for federal grant reporting could be implemented, it is necessary to summarize the history of grant reporting policy reforms.

History of Grant Reporting Reforms

The Federal Reports Act of 194235 was perhaps the earliest legislation still relevant to grant reporting processes today. The Federal Reports Act granted the White House Bureau of the Budget authority over information requests made by all federal departments and agencies to entities seeking government funding. Under this authority, the modern White House OMB acquired, and still maintains, jurisdiction over grant reporting. Two offices within OMB exercise this authority. First, the Office of Federal Financial Management (OFFM) “leads development of governmentwide policy to assure that grants are managed properly and that Federal dollars are spent in accordance with applicable laws and regulations.”36 Second, as discussed below, the Office of Information and Regulatory Affairs (OIRA) reviews and approves grant reporting forms used by agencies to collect information from grantees.

Since the passage of the Federal Reports Act, Congress and OMB have frequently attempted to address the diversity of grantmaking and grant reporting through government-wide policy reforms. The seven major policy reforms of the past quarter-century are the Paperwork Reduction Act of 1995, the Single Audit Amendments Act of 1996, the Federal Financial Assistance Management Improvement Act of 1999, the Government Performance and Results Act - Modernization Act of 2010, the Digital Accountability and Transparency (DATA) Act of 2014, the late-2014 implementation of OMB’s Uniform Grant Guidance (and related policy memos), and the Grants Oversight and New Efficiency (GONE) Act of 2016. Five out of these six reforms sought to modify the substance of grant management or grant reporting. Only the DATA Act sought to address the data structure of grant reporting.

In 1995, the Paperwork Reduction Act37 recognized the existence of the Office of Information and Regulatory Affairs (OIRA) within OMB, and tasked this office with “the review and approval of the collection of information [by federal agencies] and the reduction of the information collection burden.”38 Under the Paperwork Reduction Act, OIRA reviews and approves all of the forms and processes federal agencies use to collect information and data from non-federal respondents, including both surveys and all reporting forms for contracts and grants. The Paperwork Reduction Act allows OMB, through OIRA, to prescribe the content of grant reporting forms such as the SF-425. However, this authority has not been employed to specify the data structure of grant reporting forms, and every change triggers a months- long approval process.

Spotlight 1: Selected Grant- Related Legislation and Regulation

1942: Federal Reports Act requires all agencies to receive approval from the Bureau of the Budget (the predecessor of the White House Office of Management and Budget, or OMB) before making information requests of businesses, nonprofits, or other organizations seeking funds from the government, and grants the Bureau Director authority to designate a single collecting entity if he deems multiple agencies are making materially identical requests. [http://www.legisworks.org/ congress/77/publaw-831.pdf]

1977: Federal Grant and Cooperative Agreement Act. [https://www.grants.gov/web/grants/learn-grants/grant- policies/federal-grant-cooperative-agreement- act-1977.html]

1980: Paperwork Reduction Act requires agencies and departments to use standardized forms for pre-award grant applications. [https://www.congress.gov/bill/96th- congress/house-bill/6410]

1987 (revised 1997): Circular No. A-102 instructs all affected federal departments to adopt government-wide terms and conditions for grants to State and local governments. [https://clinton4.nara.gov/OMB/circulars/ a102/a102.html]

1995: Paperwork Reduction Act modernizes OMB’s oversight of federal information collections, including grant reporting. [https://www.gpo.gov/fdsys/pkg/ PLAW-104publ13/html/PLAW-104publ13.htm]

1996: Single Audit Act amended to streamline audits of federal grantees. [https://www.congress.gov/104/plaws/ publ156/PLAW-104publ156.pdf]

1999: Federal Financial Assistance Management Improvement Act standardizes pre-award procedures for 26 different agencies, establishes a government-wide e- government program management office for grants at HHS, and sets up a Grants Policy Council. [https:// www.gpo.gov/fdsys/pkg/PLAW-106publ107/pdf/ PLAW-106publ107.pdf]

2009: American Recovery and Reinvestment Act mandates special spending to stimulate the economy and requires grantees receiving stimulus funds to submit standardized data reports to a temporary agency, the Recovery Accountability and Transparency Board. [https://www.gpo.gov/fdsys/pkg/BILLS-111hr1enr/pdf/ BILLS-111hr1enr.pdf]

2010: GPRA Modernization Act requires the White House to publish a master list of federal programs and track performance on a program-by-program basis. [https://www.gpo.gov/fdsys/pkg/PLAW-111publ352/ html/PLAW-111publ352.htm]

2011: OMB Memorandum M-12-01 replaces the Grants Policy Council and the Grants Executive Board with the Council on Financial Assistance Reform (CoFAR). [https://obamawhitehouse.archives.gov/sites/ default/files/omb/memoranda/2012/m-12-01.pdf]

2013: OMB Memorandum M-13-13 created a government-wide open data policy. [https:// obamawhitehouse.archives..gov/sites/default/files/omb/ memoranda/2013/m-13-13.pdf]

2014: Digital Accountability and Transparency Act (DATA Act) sets up a pilot program to test the idea of a standardized data structure for reporting by grantees. [https://www.gpo.gov/fdsys/pkg/PLAW-113publ101/ pdf/PLAW-113publ101.pdf]

2014: Uniform Grant Guidance [https://www.gpo.gov/ fdsys/pkg/FR-2013-12-26/pdf/2013-30465.pdf] and OMB Memorandum M-14-17 [https:// obamawhitehouse.archives.gov/sites/default/files/omb/ memoranda/2014/m-14-17.pdf].

2016: Grants Oversight and New Efficiency (GONE) Act. [https://www.congress.gov/114/plaws/publ117/ PLAW-114publ117.pdf]

2017: OMB Memorandum M-17-26 eliminates the COFAR and provides that financial assistance policy will be addressed by the federal Chief Financial Officers council. [https://www.whitehouse.gov/sites/ whitehouse.gov/files/omb/memoranda/2017/ M-17-26.pdf]

The Single Audit Act Amendments of 199639 were implemented to streamline and simplify the process set out in the original 1984 law40 for audits of the recipients of grants. To prevent grantees receiving grants from multiple federal sources from having to undergo separate audits for each funding stream, the Single Audit Act allows entities receiving total federal grants funding over a set amount to undergo just one annual organizational audit and report that audit to the Federal Audit Clearinghouse.41 OMB sets this threshold, currently $750,000 in total awards in a given year.42 The Single Audit Act and its amendments eliminate what would otherwise be a significant compliance burden. But the Single Audit Act does not prescribe a particular data structure for the audit report, nor does it seek to allow Federal Audit Clearinghouse data to be used to prepopulate other types of grant reports.

In 1999, Congress enacted the Federal Financial Assistance Management Improvement Act,43 which set up Grants.gov, a single portal for grant announcements and applications. The Federal Financial Assistance Management Improvement Act did much to centralize pre-award activities. An exploration of Grants.gov application packages reveals the vast majority to be comprised predominantly or even solely of common forms, though often with considerable space for attachments.

But Congress’ original goal of creating a single point of activity for post-award grant reporting and management was not achieved.44 When the Department of Health and Human Services performed an (incomplete) inventory of the post-award forms associated with HHS programs, its team discovered over 40045 individual information collection documents with distinct OMB control numbers, containing over 11,000 individual data elements.46

The Government Performance and Results Act - Modernization Act of 2010 (GPRA-MA)47 was intended to streamline the original 1993 legislation and increase efficiency both within agencies and within the government performance improvement process itself. GPRA-MA requires agencies to create performance improvement goals aligned with their stated mission, and to create strategic plans to achieve those goals. This affects the federal grantmaking community in two ways. First, grant-based activity represents a significant portion of almost every agency’s mission which means that, at least in theory, tracking and improving the outcomes of an agency’s grants are included in its strategic planning. Second, GPRA-MA arose out of a growing movement towards implementing and refining evidence- based decision-making throughout government – a movement that is frustrated by the lack of comprehensive transparency in grant report data.

In 2011, OMB issued Memorandum M-12-0148, which replaced the Grants Policy Council (1999) and the Grants Executive Board (2004) with the Council on Financial Assistance Reform (COFAR) as part of the President’s initiative on Delivering an Efficient, Effective, and Accountable Government. The intention was to create “an institutionalized, formal coordination body over Federal grants and cooperative agreements”49 which could not only represent the financial assistance community in federal government, but would seek solutions to the challenges faced by grantees and find ways to improve the processes and procedures through which federal grants are offered and administered. The COFAR was intended to improve both the efficiency and effectiveness of financial management “by coordinating the development and implementation of a standardized business process, data standards, metrics, and information technology” and by “eliminating unnecessary regulatory, reporting, and grant-agreement requirements and ... increasing flexibilities for satisfying grant requirements”50. Six years later, in Memorandum M-17-26 OMB disbanded the COFAR, and assigned its priorities instead to the Chief Financial Officers Council51.

In December 2013, OMB published52 the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Grant Guidance), an attempt to knit together all of its grants-related rules for agencies and grantees – previously expressed in eight different publications – into a single section of the Code of Federal Regulations.53 The Uniform Grant Guidance became binding in December 2014.54 OMB promised that the UGG would “reduce the total volume of financial management regulations for Federal grants and other assistance by 75%, and reduce administrative burdens and risk of waste, fraud, and abuse for the approximately $600 billion in Federal grants expended annually.”55 In Memorandum M-14-1756, OMB set forth a plan for the COFAR to evaluate whether the Uniform Grant Guidance was actually reducing administrative burdens. However, these evaluations were reassigned to the CFO Council by Memorandum M-17-26, which eliminated the COFAR.57

In 2014, Congress unanimously passed the Digital Accountability and Transparency Act (DATA Act)58, and President Obama signed it into law on May 9, 2014. The DATA Act is the nation’s first open data law. It directs the Treasury Department and OMB to create a standardized data structure for federal agencies’ spending information; requires every agency to begin reporting its spending as open data, conforming to the data structure; and mandates for the Treasury Department to aggregate and publish all this information as a single, unified open data set, covering the whole picture of executive-branch spending.59 Under the DATA Act, Treasury and OMB created a data structure known as the DATA Act Information Model Schema, or DAIMS.60 Every federal agency began reporting spending data files consistent with the DAIMS by May 9, 2017.61 By creating and imposing a common data structure for agencies’ reports on their own spending, the DATA Act has created a new means of government-wide spending transparency and data-driven management.

The DATA Act also sought to encourage the adoption of a common data structure for grantees’ reports, though it did not directly mandate such a result. Section 5 of the DATA Act directed OMB to run a pilot program to test and develop recommendations for:

(A) standardized reporting elements across the Federal Government;

(B) the elimination of unnecessary duplication in financial reporting; and

(C) the reduction of compliance costs for recipients of Federal awards.62

The activities of this Section 5 Pilot Program form the basis for this paper’s recommendations and are further discussed below.

The Grants Oversight and New Efficiency (GONE) Act of 201663 was intended to address the severe systemic issue of unclosed expired grants. It requires each granting agency to report to OMB, in conjunction with HHS, a list of every federal grant award they administer that has been expired for more than two years but is still listed as ‘open;’ the total number of open, expired grants, including by period of expiration; the total number that still have funds in their associated accounts; and the total number which have zero balances but remain unclosed. They must also submit a document describing the various roadblocks, systemic bottlenecks, and other factors which disrupt their ability to spend down and close grants in a timely fashion, and then identify and explain in specific detail the reasons why each of their agency’s 30 oldest grants have not been closed.

Stimulus Grant Reporting Shows the Promise of Open Data

The federal government’s first real step toward a standardized, open data structure for grant reporting did not originate with Congress, nor was it initiated by the government-wide grants policy leadership at OMB. Instead, the first demonstration of the potential for open data to improve information delivery and compliance efficiency came from the temporary agency that oversaw the federal economic stimulus program, which began in 2009.

The American Recovery and Reinvestment Act of 200964 mandated approximately $1 trillion in stimulus spending, including over $300 billion in special grants and contracts. The law set up a temporary agency, the Recovery Accountability and Transparency Board (RAT Board), to oversee stimulus spending, and empowered it to collect and publish information on the disbursement, receipt, and use of such funds.65 The law also required grantees and contractors receiving stimulus grants and contracts to file special reports on them – in addition to all of their regular compliance requirements.66

To ensure that information about stimulus grants and contracts would be easily available for oversight, management, and public transparency, the RAT Board created a standardized data structure for the grantees’ and contractors’ special stimulus reports, and set up a single portal for the submission of these reports, known as FederalReporting.gov.67 The RAT Board also created a data analytics platform that aggregated all of the stimulus reports as a single, unified data set and combined it with other relevant government-wide data sources, such as the Social Security Administration’s master death file, in order to inform anti-fraud analytics by agency inspectors general.68

The RAT Board’s decision to apply a standardized data structure to stimulus reports succeeded beyond the law’s original goals. The RAT Board’s data analytics platform, known as the Recovery Operations Center, facilitated investigations that led to the recovery and savings of over $100 million in payments to questionable grantees and contractors.69 As a result of the use of the Recovery Operations Center by inspectors general and the public scrutiny, the observed rate of fraud was far lower than for non-stimulus spending70 and the RAT Board’s efforts were praised by both supporters and opponents of the underlying stimulus law.71

Meanwhile, the standardized data structure allowed technology companies to create software that allowed stimulus grantees to comply automatically with the special reporting requirement. Because the data structure of stimulus reports was uniform – even for stimulus grants and contracts awarded by different agencies – this software was able to automatically pull the correct financial information from existing financial management systems, compile it for review, and submit to the RAT Board.72

The RAT Board decided to test whether its standardized data structure and FederalReporting.gov portal could be used for regular (non-stimulus) grant reports. In the Grants Reporting Information Project (GRIP), the RAT Board invited nine grantees, who had received 25 different stimulus grants from 11 agencies, to submit their SF-425 financial information as standardized data via FederalReporting.gov.73

The RAT Board found that its data structure and the FederalReporting.gov portal could be “easily modified to accommodate SF-425.”74 Grantees were able to submit their SF-425 financial information easily. Grantees told the RAT Board that they could reduce their compliance costs “by submitting reports to one central source, using standard data, transmitting data in a standard format, and uploading multiple reports in one machine readable file.”75 Grantees further predicted that if the federal government were to adopt a comprehensive data structure for all grant reporting – particularly an unchanging standard grant award identifier – their software would be able to prepopulate information into the SF-425 and other forms, further reducing costs.76

The GRIP also revealed that a standardized data structure would benefit grantmaking agencies:

A government-wide centralized reporting mechanism would eliminate agency duplication of efforts, including development and maintenance of systems, help desk support, and data entry (e.g., paper forms submitted to agencies and then entered into agency systems by agency personnel). In addition, any mandated changes to standard data elements or other reporting requirements would occur once, ensuring a quick and truly government-wide implementation.77

In its report on the GRIP, the RAT Board recommended:

- An adoption of financial reporting data standards and standardized business processes will reduce burden and improve efficiencies if implemented across the federal government.

- A centralized financial reporting system should allow for multiple electronic reporting mechanisms with an emphasis on bulk or batch XML filing.

- A unique award numbering scheme should be considered for government-wide implementation. This, along with more stringent data quality assurance measures within USASpending.gov, could enable seamless pre-population of some reporting data fields.

- A full centralized reporting pilot should be conducted using standard data elements that could be used government-wide (e.g., FFR/SF-425). The pilot should use a standardized financial reporting frequency, and include a thorough time and resource evaluation to more adequately measure burden reduction. If the pilot is successful, centralized reporting should be used government- wide.78

The RAT Board’s conclusions reflected the experiences of only nine grantees. But, with the DATA Act, Congress set up a much larger test.

DATA Act Pilot Program Creates the Consensus for Open Data

The Uniform Grant Guidance sought to “increase the impact and accessibility of programs by minimizing time spent complying with unnecessarily burdensome administrative requirements, and so reorient recipients toward achieving program objectives.”79 While the UGG does ease conflicting guidance and regulation stemming either from previous memoranda or from minutely different phrasing or interpretation by agencies pushing regulations down to their grantees, its approach is inherently document-based.

Even after the implementation of the UGG, and despite decades of grant-related policymaking, grantmaking agencies and grant recipients still rely on static PDF-based forms, and cannot call upon universally-accepted data definitions and attributes to automate their processes. As a result, information delivery and grantee compliance remain more elusive and more expensive than they need to be. With the DATA Act, Congress addressed the need for an open data transformation for the first time.

When Rep. Darrell Issa and Sen. Mark Warner first introduced the DATA Act in June 2011,80 they proposed to create a new, government-wide open data structure for all federal spending information – encompassing both information reported by agencies and reports from the recipients of federal grants and contracts. The original DATA Act would have turned the RAT Board into a permanent government agency, directed it to set data standards for agency-reported and recipient-reported information, and empowered it to collect standardized spending data from both agencies and recipients.81 Had this bill become law, the newly-permanent RAT Board would have been able to directly implement its GRIP recommendations.

However, both the White House and the Treasury Department objected to the idea of creating a new government agency.82 Therefore, the DATA Act’s sponsors revised their bill to direct Treasury and OMB, instead of a permanent version of the RAT Board, to create data standards.83

The revised DATA Act also became less ambitious about transforming grant reporting than the original bill. Rather than providing a full mandate for all federal grantees to begin reporting standardized data, the final law, as enacted in May 2014, established a pilot program. OMB would test grant reporting data standards first, then later have an option – but not a statutory obligation – to impose such standards across all of the government’s grant programs.84

The pilot program was mandated by Section 5 of the law. Congress directed OMB to

facilitate the development of recommendations for— (A) standardized reporting elements across the Federal Government; (B) the elimination of unnecessary duplication in financial reporting; and (C) the reduction of compliance costs for recipients of Federal awards.85

OMB chose the Department of Health and Human Services – the largest federal grantor agency – to run this pilot program, which began in May 2015 and was completed in May 2017.86

To test whether an open data structure might reduce duplication and compliance costs, HHS created one: the Common Data Element Repository Library, or CDER Library.87 In essence, the CDER Library is a data dictionary, providing specific definitions to a set of terms which then allows those terms to be translated between agencies, departments, and different points in the reporting data stream. The concept is simple, and in some ways the process is as well. To create the CDER Library, HHS’ team set about initially to identify as many OMB-approved forms as they could within HHS. From these forms, they identified distinct data elements - those with either unique terms or unique definitions.

196 forms and element sources were selected for inclusion in the pilot from 18 different agencies, including HHS’ Administration for Children and Families, HHS’ GrantSolutions shared service, the National Institutes of Health, the Health Resources and Services Administration, the Department of Agriculture, and the Department of Education. HHS’ team also incorporated data elements directly from the UGG and from DATA Act Information Model Schema (DAIMS). 15,338 elements were identified from these sources, which were harmonized down to a total of 11,397.88 Within the CDER Library, each standardized element has an individual field label and attributes to ensure that meaning and structure is clear for both the people interacting with the data and the machines attempting to parse and analyze it.

HHS’ team invited over 350 grantees to submit selected grant reports as standardized data. These activities were organized into six test models, including two that specifically utilized the CDER Library and its data elements.89 HHS shared the results of these activities with OMB, and OMB issued a final report on the pilot program on August 10, 2017.90

The report illuminated several distinct benefits of data standardization for grantees. First, even without being able to automate reporting, grantees benefited from using the CDER library as a reference. “Grantees who had access to the CDER Library completed [their grant reporting] forms more accurately than those who didn’t.”91 Second, HHS offered grantees an opportunity to submit selected financial reports electronically, using standardized data fields, rather than as PDF documents, and these grantees reported their processes became cheaper and more accurate.92 Third, HHS created a special, standardized version of the Notice of Award (NOA), whose data fields could be used to prepopulate other forms. “[G]rantees reported that they were able to use the standardized data fields to complete other forms faster and more accurately – and if the NOA were officially standardized across government, they could ‘engage in more advanced or automated mechanisms for collecting grant award information.’”93

Based on HHS’ activities and these findings, OMB issued three recommendations:

Recommendation 1: Continue to standardize data elements, conditions, and attributes to meet the statutory, regulatory and business needs of the various communities.

Recommendation 2: Eliminate unnecessary duplication in reporting by leveraging opportunities to use information technology that can easily auto-populate from relevant existing Federal data sources.

Recommendation 3: Leverage information technology open standards to rapidly develop any new tools needed.94

As part of recommendation #1, OMB committed to

developing a comprehensive taxonomy of standard definitions for core data elements required for managing Federal financial assistance awards. This taxonomy could be made public in a machine- readable format, which could form the basis of shared software as a service for both Federal and state, local, tribal, university, and nonprofit parties.95

The findings of the Section 5 pilot program and OMB’s ensuing recommendations remove any doubt: the federal government will move forward, soon, to adopt a government-wide open data structure for grant reporting. However, the specific contours of the coming mandate96 and the timing remain uncertain.

Similarly the CDER Library represents the government’s first conscious attempt at a government-wide open data structure, and the Section 5 pilot program results show that the attempt was successful. So, too, do the results of a pilot program conducted by the Environmental Protection Agency separately from OMB’s and HHS’ Section 5 activities. The CDER Library is not the only possible foundation for the necessary open data structure but it is, today, the best-developed.

Spotlight 2: The EPA’s Grant Reporting Pilot Program

In 2016, StreamLink Software, the Environmental Protection Agency, and the Standing Rock Sioux Tribe partnered together to conduct a pilot program to test the use of standardized data to fulfill grant reporting requirements. The pilot program covered three single- fiscal-year grants from the EPA to Standing Rock, with awards totaling $1.1 million and grant terms from October 1, 2016, to September 30, 2017. All three grants provided reimbursements for environmental testing and cleanup activities conducted by Standing Rock.

The EPA agreed to receive financial and performance information for these grants in the form of standardized data, submitted by Standing Rock within StreamLink Software’s AmpliFund software, rather than using the usual PDF documents. StreamLink Software incorporated selected data elements from the CDER Library into the software, and provided access to both the EPA and Standing Rock.

StreamLink Software worked with Standing Rock to integrate AmpliFund with Standing Rock's existing financial systems, so that Standing Rock's financial transactions could be electronically uploaded into the software, expressed using the data elements from the CDER Library. As a result, when Standing Rock spent its funds on environmental testing and cleanup, these transactions were then reflected within AmpliFund. (For the pilot program, transactions were uploaded from Standing Rock’s systems at intervals, through manual intervention, but StreamLink Software plans to automate these uploads in the future.)

Standardized Data Automates Grant Reimbursement Process

Like many federal grant agreements, the three pilot grant agreements each dictated an agreed budget and required Standing Rock to report on its progress against that budget every quarter, and then receive reimbursement from the EPA for specified expenses. Using CDER data elements, AmpliFund handled this whole process. Standardization improved the process in three key ways.

- Normally, the agreed budget for a grant is separately maintained by a grantor agency and its grantee entity, and both grantor and grantee separately track the impact of the grantee's qualified transactions on that budget. But with a standardized data structure loaded into AmpliFund, both Standing Rock and the EPA were able to view the same budget, saving effort.

- Normally, a grantor agency does not know what its grantee is doing until it receives a quarterly request for reimbursement. But through its access to AmpliFund, the EPA could track Standing Rock’s transactions in a much more timely fashion.

- Normally, a grantee must manually prepare a quarterly request for reimbursement, by extracting data about its transactions from its financial systems, turning that data into a spreadsheet, embedding that spreadsheet into a document, and submitting the document to the grantor agency. But here, Standing Rock was able to simply press a button at the end of each quarter to certify to the EPA that its transactions for the quarter were complete, and that a reimbursement was due.

Standardized Data Automates the Annual Report

Standing Rock used AmpliFund to compile its required SF-425 form, the annual report, for each of the three pilot grants. Normally, a grantee must manually extract data from its financial systems, compile it into spreadsheets, and embed those spreadsheets into a document in order to create the SF-425 submission. But here, AmpliFund sourced the necessary information from Standing Rock's financial systems and created an electronic version of the SF-425 conforming to the CDER data elements. Upon publication of this research report, Standing Rock intended to submit electronic versions of the SF-425s for each of the three pilot grants to the EPA electronically, within the software.

Standardized Data Automates Performance Reporting

Standing Rock also used AmpliFund to track its progress toward completing the specific deliverables specified in each grant agreement, and keep the EPA informed of that progress. The EPA could see Standing Rock's progress through its access to AmpliFund.

Normally, a grantor agency cannot see its grantee's progress toward meeting the performance goals or deliverables of a grant until the grantee completes and submits a report at the end of the grant period. But here, the EPA could easily see Standing Rock's progress toward each deliverable, as the work was done, all throughout the grant period, and the final report merely confirmed what the EPA had already been tracking through its access to AmpliFund.

Normally, a grantee must manually compile performance reports before the end of the grant period and turn them into a document, and then submit that document to the grantor agency. But here, AmpliFund both served as a project- management tool for Standing Rock's performance and also automatically generated a summary at the end of the grant period that fulfilled Standing Rock's obligation to submit summary reports.

The pilot program is now complete. Standing Rock and the EPA are currently considering making this arrangement permanent and extending it to other grants, including possibly grants from other agencies.

Reporting both financial and performance details in a standardized, open data structure, embedded within grant management and reporting software, was much cheaper for the grantee, Standing Rock, than undertaking the same compliance tasks using the conventional PDF documents. The EPA benefited, too. Rather than having to receive document-based reports from its grantee and input the information from those reports into its systems to create financial and performance data, the EPA got instant access to that data in a single software environment, for automatic and comprehensive transparency.

The pilot program demonstrates that AmpliFund, and other grant management software solutions, can use standardized data elements to reduce grantees’ compliance costs, improve transparency for grantors, and benefit all taxpayer and the constituencies that depend on grants.

Seizing an Open Data Future for Grant Reporting

Undoubtedly, there are challenges to be overcome. As with any significant process change, financial cost is chief among them. While the technology necessary to transform the whole reporting environment exists, and in fact has for more than two decades, there are significant variances in capacity within and across stakeholder groups. Some federal agencies, as well as state and municipal grant management offices, have lacked either the funding or the foresight to incorporate the use of standardized, open data frameworks in their strategic IT planning - particularly in regards their grant management systems - and may be at least temporarily locked into systems which are expensive or even resistant to overhaul due to inflexible structures.

Moreover, well-intended attempts to alter cascading systems have historically been prone to becoming unfunded mandates. When cost-saving measures require an initial outlay that is not incentivized by cost- sharing, if not full funding, the resulting implementations are often slow and functionally incomplete. This can cause benefits to go unrealized, new duplications to arise from the creation of parallel systems and their associated administration, and additional spending which cancels out anticipated savings.

Awareness is also a significant challenge. A continued paucity of outreach will perpetuate a compliance- oriented culture. Buy-in is most easily gained prior to a mandate, which can sound like an increased burden instead of an improvement if it appears seemingly overnight as a fait accompli. While some states are turning towards integrated systems and forward-thinking technology solutions, many agencies and organizations are not aware of the ongoing efforts towards standardized, computer readable data and assume they would be working in a vacuum were they to attempt to address these issues.

Further, at all levels of government there is an entirely right and necessary focus on oversight and accountability, but this has resulted in the accumulation of redundancies placing undue burden on grantees. Even with recent revisions to the Single Audit Act, it is not uncommon for nonprofits (particularly smaller organizations which do not meet the Single Audit threshold and on whom excessive burden weighs heaviest) to be under some variety of financial or compliance audit for most of the year, as each of their grantors perform uncoordinated independent reviews. Each jurisdiction, be it federal, state, or municipal agency, has slightly different requirements for statutory and programmatic compliance. This in and of itself is logical, as each maintains separate authority, autonomy, and governance over programs it funds through its own resources, but the significantly overlapping nature of said requirements indicates that even a partial coordination of related systems and processes would improve what is currently an extremely inefficient system, and a significant drain of time and resources for all involved.

Finally, and perhaps most significantly, grantees’ ability to present a narrative must be addressed. In any discussion about standardizing data, there is always concern from grantors and grantees about lost narrative. Narrative is an intrinsic and crucial feature of grant reporting. Almost all grant reporting contains narrative components, and it cannot and should not be forsaken in favor of a purely quantitative system. Baselining and benchmarking can only be done through quantitative analysis, and our capacities in those areas must be improved if there is a desire to make well-informed, impactful changes to programs. But context is everything when discussing impact and outcomes, and even the most efficient, accurate national and regional baselining and benchmarking cannot provide sufficiently current or nuanced understanding of prevailing conditions as to render narrative unnecessary.

There is likewise concern about narrative and context in the higher levels of federal agencies, and particularly around the topic of governance. Specifically, it accompanies any discussion of the current lack of governance, which over time has become a glaring omission. Grant spending has surpassed acquisitions, yet the latter has a statutorily defined governance organization and the former does not. The objections to consolidated governance generally hinge on diversity. As discussed earlier, often even within agencies the goals and outcomes of programs are so disparate as to seem incomparable. The concern is not unfounded - a simplistic, one-size-fits-all solution would be not only unworkable but counterproductive. But simplistic, one-size-fits-all solutions are not the only ones available to create a governance structure for federal grants and other forms of financial assistance.

Despite all these challenges, it is clear that the federal government should, and soon will, embrace an open data structure for grant reporting.

The federal grant system as a whole is creaking under the weight of the reporting status quo, which disadvantages every group involved. Standardized, computer-readable data is crucial to rectifying the many issues of disparity, duplication, infidelity, and incomplete communication. While not without its challenges, more concerted effort must be made to ease the administrative burden incumbent on all federal grantees, and that effort must begin by liberating data from static forms and implementing a data dictionary across the all federal grant agreements. More efficient use of the considerable funds expended by the federal government on grants can be achieved at every point and for every stakeholder with open, machine-readable data. From faster and more accurate reporting to lower costs for compliance and data storage, and from better oversight to better insight, static PDFs and unmapped data hamper the development of improvement culture and waste money which could otherwise be allocated to crucial programs.

The movement towards open and standardized data in government is well underway, and the realm of federal grants will soon join it.

About the Authors

Jenata Spencer – Grant Innovation Fellow, Data Foundation

Before moving into the government arena, Jenata Spencer spent more than five years as a nonprofit consultant in Washington DC, specializing in grant writing, full life-cycle grant management, and data collection and analysis.

As the Grant Innovation Fellow at the Data Foundation, Ms. Spencer worked with federal, state, nonprofit, and technology stakeholders to understand the inner workings of the nation's granting systems. She is grateful for the support of the many people who were instrumental in the creation of this report for their willingness to share their time and knowledge.

Ms. Spencer currently serves as a Grants Business Analyst at REI Systems, where she uses her interest in automation and data to help government clients leverage technology to improve their processes, insights, and outcomes.

Hudson Hollister – Executive Director, Data Foundation

Hudson Hollister is the founder and Executive Director of the Data Coalition, a trade association representing technology and consulting firms supporting open data in government. The Data Coalition is the main advocacy group for the implementation of the DATA Act of 2014, transforming the U.S. federal government's spending information into standardized, open data. The Data Coalition also supports data standards to transform regulatory compliance, legislative mandates, and the whole landscape of government invitation. Mr. Hollister has helped to craft landmark reforms, including the DATA Act, the OPEN Government Data Act, the Financial Transparency Act, and the Grant Reporting Efficiency and Agreement Transparency (GREAT) Act.

Mr. Hollister is also the founder of the Data Foundation, a nonprofit think tank seeking to define an open future for both government and private-sector data. The Data Foundation is responsible for the leading research on open data in federal spending and in regulatory compliance. The Data Foundation hosts the largest annual open data conference in the United States.

- Data from USASpending.gov (accessed November 28, 2017). ↩

See Natalie Keegan, Congressional Research Service, Federal Grants-in-Aid Administration: A Primer, October 3, 2012, at 9. ↩

Subject to OMB’s Uniform Grant Guidance, codified at 2 C.F.R. § 200 et seq., every grantee must report annually on each grant to the grantor agency. ↩

See www.fsrs.gov (accessed November 28, 2017). ↩

Audit Requirements, 2 C.F.R. § 200.500-21 (2015), see also harvester.census.gov/facweb/ (accessed November 28, 2017); see also Keegan, supra note 2, at 11. ↩

Data from USASpending.gov (accessed November 28, 2017). ↩

Data from Catalog of Federal Domestic Assistance Programs, www.cfda.gov (accessed July 18, 2017). ↩

Interview with HHS staff. ↩

See White House, Grants Management Forms, www.whitehouse.gov/omb/grants_forms (accessed November 28, 2017). ↩

Recovery Accountability and Transparency Board, Grants Reporting Information Project (“GRIP”) (registration required), at 5. ↩

Recovery Accountability and Transparency Board, Grants Reporting Information Project (“GRIP”) (registration required), at 2. ↩

Subject to OMB’s Uniform Grant Guidance, codified at 2 C.F.R. § 200 et seq., every grantee must report annually on each grant to the grantor agency. ↩

Audit Requirements, 2 C.F.R. § 200.500-21 (2015), see also harvester.census.gov/facweb/ (accessed November 28, 2017). ↩

See www.fsrs.gov (accessed November 28, 2017). ↩

White House Office of Management and Budget, Report to Congress: DATA Act Pilot Program, August 10, 2017, (“OMB DATA Act Report”), at 55. ↩

Government Accountability Office, 2017 Annual Report: Additional Opportunities to Reduce Fragmentation, Overlap, and Duplication and Achieve Other Financial Benefits, Report No. GAO-17-491SP, April 2017, (“GAO Duplication Report”). ↩

Government Accountability Office, 2017 Annual Report: Additional Opportunities to Reduce Fragmentation, Overlap, and Duplication and Achieve Other Financial Benefits, Report No. GAO-17-491SP, April 2017, (“GAO Duplication Report”) at 65. ↩

Sarah Pettijohn, Elizabeth Boris, and Maura Farrell, Urban Institute, National Study of Nonprofit Contracts and Grants 2013: State Profiles, May 14, 2014. ↩

OMB DATA Act Report, supra note 15, at 55. ↩

See also Keegan, supra note 2, at Summary (“This variation in federal grant administration makes it difficult for Congress to compare program performance, both within and among federal agencies, and to exercise its oversight of federal agencies”). ↩

GAO Duplication Report, supra note 16, at 66 (“By standardizing administrative requirements for federal research grants, agencies could achieve reductions in universities’ administrative workload and costs while maintaining accountability over grant funds”). ↩

See Section 4, infra. ↩

See Section 4, infra (discussing OIRA approval process). ↩

See Government Accountability Office, DATA ACT: Data Standards Established, but More Complete and Timely Guidance Is Needed to Ensure Effective Implementation, GAO-16-261, January 2016, (discussing best practices for data standards). ↩

See Government Accountability Office, Government is Analyzing Alternatives for Contractor Identification NumbersGAO-12-715R, June 12, 2012, at 2. ↩

For more on the drawbacks of proprietary identifiers, see Scott Strab and Matt Rumsey, Data Foundation, Who is Who and What is What?: The Need for Universal Entity Identification in the United States, September 2017. ↩

See Hudson Hollister, Joseph Kull, Michael Middleton, and Michal Piechocki, Data Foundation, Data Foundation, Standard Business Reporting: Open Data to Cut Compliance Costs, March 13, 2017, (“SBR Report”). ↩

See Hudson Hollister, Joseph Kull, Michael Middleton, and Michal Piechocki, Data Foundation, Data Foundation, Standard Business Reporting: Open Data to Cut Compliance Costs, March 13, 2017, (“SBR Report”) at Introduction. ↩

See Hudson Hollister, Joseph Kull, Michael Middleton, and Michal Piechocki, Data Foundation, Data Foundation, Standard Business Reporting: Open Data to Cut Compliance Costs, March 13, 2017, (“SBR Report”) at Introduction. ↩

Digital Accountability and Transparency Act of 2014, Public Law No. 113-101 (May 9, 2014), www.gpo.gov/fdsys/pkg/PLAW-113publ101/html/PLAW-113publ101.htm; see also Data Coalition, “DATA Act” (website), www.datacoalition.org/issues/data-act/ (accessed December 2, 2017); see also Frank Landefeld, Jamie Yachera, and Hudson Hollister, Data Foundation, The DATA Act: Vision & Value, July 2016, available at www.datafoundation.org/data-act-vision-and-value-report/ (“Vision & Value”); see also Dave Mader, Tasha Austin, Christina Canavan, Dean Ritz, and Matt Rumsey, Data Foundation, DATA Act 2022: Changing Technology, Changing Culture, May 2017, available at www.datafoundation.org/data-act-2022/ (“DATA Act 2022”). ↩

See Hudson Hollister, Data Coalition Blog, “This data set took six years to create. Worth every moment.,” May 9, 2017, (“Worth Every Moment”). ↩

See Hudson Hollister, Data Coalition Blog, “This data set took six years to create. Worth every moment.,” May 9, 2017, (“Worth Every Moment”). ↩

DATA ACT: OMB, Treasury, DATA ACT: OMB, Treasury, and Agencies Need to Improve Completeness and Accuracy of Spending Data and Disclose Limitations November 2017, at 8, et seq. ↩

See Vision and Value, supra note 30, at IV; see also Department of the Treasury, “Data Lab at USASpending.gov,” (accessed November 30, 2017) (providing management and transparency tools using standardized federal spending data). ↩

Federal Reports Act, Pub. L. 77-831 (December 24, 1942). ↩

See White House, “Federal Financial Management, Grants Management,” (accessed November 30, 2017). In addition, Section 503(b)(2)(c) of Chief Financial Officers Act of 1990 assigned the management of grants and other assistance to the Deputy Director for Management, who supervises the OFFM. ↩

Pub. L. 104-13 (May 22, 1995). ↩

Pub. L. 104-13 (May 22, 1995) sec. 3503. ↩

Pub. L. 104-156 (July 5, 1996) (“Single Audit Act Amendments”). ↩

Pub. L. 98-502 (October 19, 1984). ↩

Single Audit Act Amendments, supra note 39, at sec. 7502. ↩

Uniform Grant Guidance, 2 C.F.R. § 200.501. ↩

Pub. L. 106-107 (Nov. 20, 1999). ↩

See Government Accountability Office, GRANTS MANAGEMENT: Improved Planning, Coordination, and Communication Needed to Strengthen Reform Efforts, Report No. GAO-13-383 (May 2013), at 10-11 (“However, it is unclear whether promoting shared IT systems for grants management is still a priority, and if so, which agency is in charge of this effort”). ↩

Interviews with HHS staff. ↩

See infra. (discussing DATA Act Section 5 Pilot Program). ↩

Pub. L. 111-352 (January 4, 2011). ↩