Imagine if U.S. companies' compliance costs could be reduced, by billions of dollars. Imagine if this could happen without sacrificing any transparency to investors and governments. Open data can make that possible.

This first-ever research report, co-published by the Data Foundation and PwC, explains how Standard Business Reporting (SBR), in which multiple regulatory agencies adopt a common open data structure for the information they collect, reduces costs for both companies and agencies.

SBR programs are in place in the Netherlands, Australia, and elsewhere - but the concept is unknown in the United States. Our report is intended to introduce SBR to U.S. policymakers and lay the groundwork for future change.

Introduction

Regulatory compliance imposes heavy costs on the private sector. A 2014 study commissioned by the National Association of Manufacturers, for example, estimated that U.S. federal regulations cost companies $2.028 trillion annually.1 A survey of manufacturing firms indicated that full-time staff and consultants devoted to regulatory compliance represented the majority of these costs.2

Regulatory compliance imposes heavy costs on government, too. In fiscal year 2016, the U.S. Securities and Exchange Commission estimated it would spend over half its budget to “foster and enforce compliance,”3 the Federal Reserve Board of Governors’ banking supervision and regulation division was its most expensive,4 the Internal Revenue Service planned to invest over one-third of its budget on enforcement,5 and the Census Bureau’s most expensive program, aside from the five- and ten-year economic and population censuses themselves, was the one charged with maintaining its Business Register, with information on over 31 million U.S. business establishments.6

For the private sector, regulatory compliance involves compiling information and reporting it, at periodic intervals or when triggering events occur, to government agencies. For government, regulatory compliance involves receiving, reviewing, and acting on that information. For the private sector and government alike, these tasks involve a great deal of manual labor.

In all developed countries, including the United States, regulatory compliance is fragmented by industry and by purpose. Government agencies specialize in tax, securities, banking, statistics, workforce, environmental, and many other matters. Each agency, separately, has the legal authority to impose restrictions on, and collect information from, regulated companies and other entities.

Regulatory agencies’ reporting requirements overlap with one another. For example, a 2011 study found that a large U.S. company was obliged to report substantially the same information, packaged differently, to the Securities and Exchange Commission, Federal Reserve, Census Bureau, and Bureau of Economic Analysis.7

Evidence demonstrates similar challenges faced by companies in the European Union. A consultation conducted by the European Commission Directorate General Financial Stability, Financial Services and Capital Markets Union, between September 2015 and January 2016 reveals that 288 respondents cited“Reporting and disclosure obligations” and “Overlaps, duplications and inconsistencies” as major hurdles.8

[A] 2011 study found that a large U.S. company was obliged to report substantially the same information, packaged differently, to the Securities and Exchange Commission, Federal Reserve, Census Bureau, and Bureau of Economic Analysis.

Around the world, governments are choosing to transform their information from disconnected documents into open data. For our purposes, the term open data refers to information that is made interoperable using standardized definitions and digital formats, and digitally published and freely available for use and reuse by its users.9 The key, of course, is interoperability, which allows diverse systems and organizations to exchange and use one another’s data without having to translate it.

For companies as well as agencies, open data offers significant efficiencies by reducing processing time and costs. First, if government agencies standardize data fields and formats for the information they collect, rather than expressing that information as unstructured documents, reporting companies’ software can automatically compile and report it, reducing manual labor. Quality improves; human ‘fat fingering’ is eliminated.

Second, if multiple agencies align their fields and formats with one another by adopting universal standards for overlapping information, companies can submit the same information once, rather than multiple times to each agency.

Meanwhile, open data promises to cut regulatory agencies’ costs and reduce their risks by allowing them to get and use regulatory information more quickly, shortening the processing required for data analysis. In the United States, for example, simple data matching could have revealed Bernie Madoff’s fraudulent activities before his financial firm collapsed,10 allowed agencies to quickly gauge the financial industry’s exposure to Lehman Brothers while deciding whether to initiate a bailout,11 and indicated that the fuel cell manufacturer Solyndra was the riskiest recipient of a federal loan guarantee well before its 2011 bankruptcy – if the relevant information had been available in a consumable format and in a timely manner. But because Madoff’s securities reports, Lehman’s financial filings, and Solyndra’s energy and securities disclosures were available only as disconnected documents, not open data, these insights would have required expensive, time-consuming, and purpose-built analytics projects.

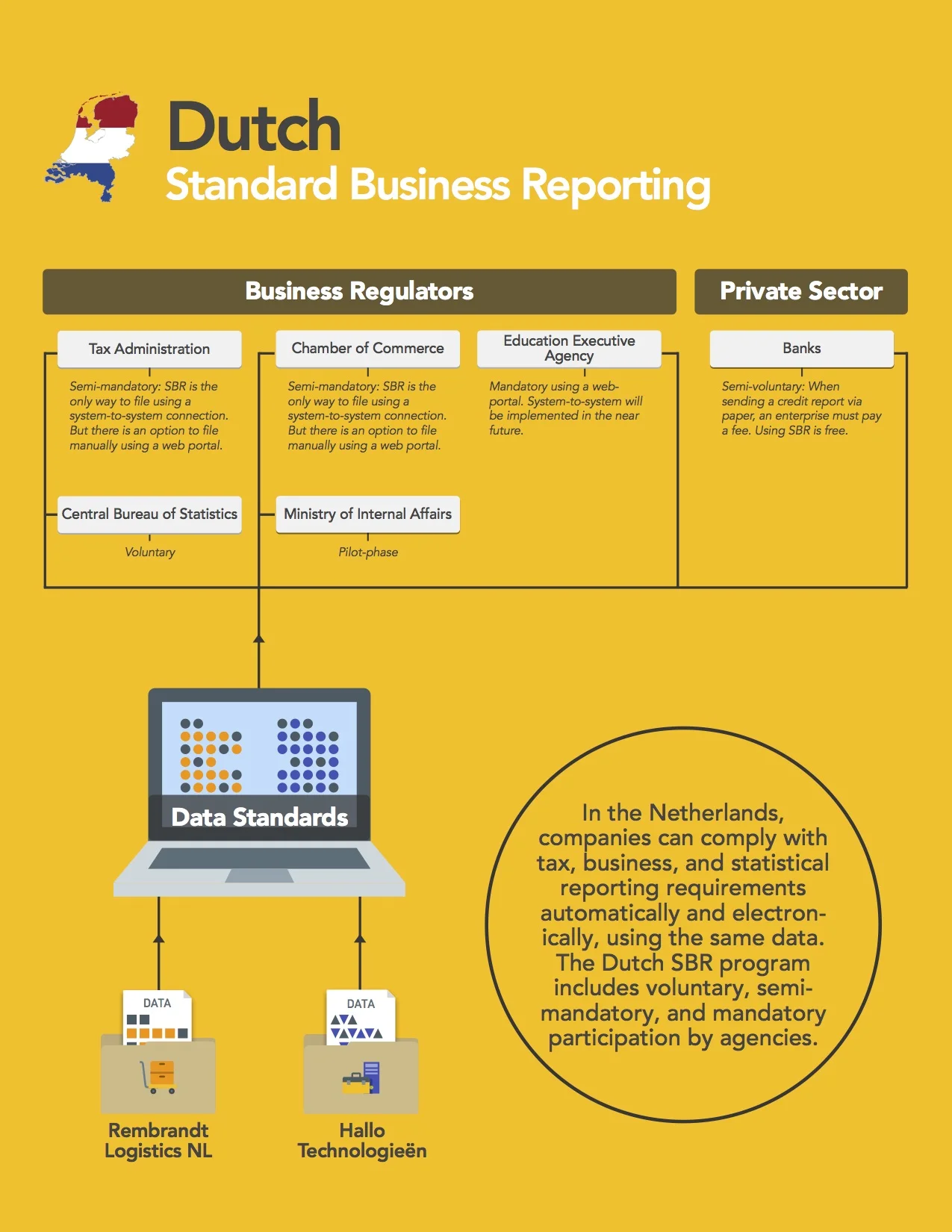

Most countries, including the United States, have not yet begun to apply open data to regulatory reporting. We will look at two prominent exceptions, the Netherlands and Australia, which have both embraced an approach known as Standard Business Reporting (SBR). SBR brings multiple government agencies together to define consistent data standards across their compliance requirements. In both the Netherlands and Australia, SBR reduces the manual labor of compliance, eliminates duplicated efforts of overlapping reporting requirements, and allows agencies to apply analytics.12

The Australian Tax Office estimated that Australia’s SBR program saved the government and companies $1.1 billion in compliance costs during the 2015-16 fiscal year.13

With Australia and the Netherlands showing the way forward, this paper defines SBR, surveys the histories and results of the Dutch and Australian SBR programs, and envisions how a U.S. SBR program might begin, grow, and succeed.

Defining Standard Business Reporting

Standard Business Reporting (SBR) refers to the adoption of a common data structure across multiple regulatory agencies’ reporting requirements. The path to SBR begins with creating that common structure, usually centered on a taxonomy, or shared dictionary of data fields.

In an SBR environment, multiple agencies cooperate and agree to define the terms in the taxonomy and use it to represent the information that they collect from their regulated entities. Regulated entities then submit their regulatory information electronically, using the taxonomy. In some countries, including Australia, the SBR program expands to also include harmonized processes and channels of data submission through shared government centers.

In an SBR environment, companies can fulfill multiple regulatory reporting requirements simultaneously, while regulatory agencies can reduce or eliminate duplicative reporting systems. Meanwhile, more timely data allows agency investigators to instantly explore regulatory information across multiple reporting regimes. Finally, standardization opens new worlds of searchable data to investors and markets.

In a 2009 paper introducing the concept to tax agencies, the Organization for Economic Cooperation and Development (OECD) defined SBR using four main steps:

Creating a national … taxonomy which can be used by business to report [regulatory] information to Government. That taxonomy could encompass all [regulatory] data from outset or be built up gradually [;]

Using the creation of that taxonomy to drive out unnecessary or duplicated data descriptions [;]

Enabling use of that taxonomy for financial reporting to Government and facilitating straight-through reporting for many types of report[s] direct from accounting and reporting software in use by business and their intermediaries; and

Creating supporting mechanisms to make SBR efficient where they do not already exist (a single Government reporting service or portal or gateway, etc.)[.]14

First, SBR involves the creation of an open data taxonomy that captures the information that private-sector companies must report to government agencies. In developed countries, regulatory agencies typically collect information from companies using document-based forms. In the United States, some agencies have modernized their forms by replacing documents with open data formats that convey each piece of information in its own defined field. Other agencies continue to collect forms as documents, in which all information is simply conveyed as unstructured text.15

Under SBR, however, these modernization efforts move forward in a more coordinated fashion, with multiple agencies agreeing on the same data elements. The ideal result is that multiple agencies’ information collections eventually become interoperable with one another: one open data set. The SBR approach focuses on common data elements and properties, rather than harmonizing processes or establishing shared data warehouses. Therefore, SBR brings standardization across multiple regulatory agencies while still honoring operational variations.

From a practical standpoint, implementing SBR requires top-down support through a single government entity empowered to create, impose, and maintain a taxonomy. Without a single agency or other authority designated as the lead entity, no one regulatory agency has sufficient authority or expertise to build a data structure expressing other agencies’ reporting requirements.

Second, the taxonomy should identify duplicative reporting requirements and overlapping concepts, and either eliminate or consolidate them to bring all reporting requirements together into a single structure.

For example, where two agencies are collecting the same piece of information – a company’s name, for instance – the taxonomy can reflect both with just one data field. Where two agencies are collecting substantially the same piece of information, the taxonomy might adopt a definition that can be used by both (or, in the case of mathematical relations, a business rule describing the mathematical difference). Or suppose the taxonomy’s creators discover that two agencies are collecting similar pieces of information, but with some differences. This partial overlap is an opportunity to clarify the requirement and possibly eliminate it.

Third, companies must be required to comply with reporting requirements electronically, by submitting data encoded using the taxonomy. To this end, agencies participating in the SBR program must be prepared to accept reports electronically. Importantly, as in the case of the Dutch SBR program, the taxonomy may cover both requirements that are common across multiple agencies and those that are specific to just one agency.

Fourth, the lead entity should encourage the creation of supporting technologies, embracing public-private partnerships where necessary and practicable. These might include a single, government-wide electronic portal for regulatory reporting; platforms to integrate compliance with a company’s other business functions; or private-sector software tools enabling users to access and analyze regulatory data.

The OECD points out that the third and fourth steps “are essentially technology infrastructure-related [steps] for which there are proven solutions.”16 The core challenges of the first and second steps, by contrast, are organizational and programmatic, not technological.

Standard Business Reporting in the Netherlands

The government of the Netherlands hosts the world’s oldest and, to date, most successful SBR program. The program’s roots date to 2002, when the Ministry of Economic Affairs initiated a public-private venture to use technological solutions to address the private sector’s compliance burdens.17 One of the solutions developed by this venture was a single, government-wide electronic address for the submission of regulatory filings, known as the Overheidstransactiepoort, or OTP.

Inspired by the OTP’s concept of electronically-standardized reporting, the Ministries of Justice and Finance started the Netherlands Taxonomy Project (NTP) in 2004.18 The NTP released the first version of its Netherlands Taxonomy, covering companies’ financial and fiscal information, in June 2005. Despite efforts in the public and private sectors to move the concept forward, by the beginning of 2009, the Netherlands Taxonomy Project had not yet delivered the contemplated compliance savings. Fewer than 10,000 filings were being submitted annually using the Netherlands Taxonomy, out of the hundreds of thousands of regulatory submissions submitted each year by Dutch companies.19

The Dutch government concluded that the program was focusing on design over implementation, and refocused on implementing within just three agencies: the Chamber of Commerce, the Tax and Customs Administration, and Statistics Netherlands.20 In particular, “the Tax and Customs Administration presented a plan to start phasing out (from 2013 onwards) the information exchange channel that competed with SBR.”21

Meanwhile, the government adopted the term Standard Business Reporting to better communicate the program’s

meaning and purpose. In the fall of 2009, the SBR Council, a new steering committee representing the highest level of the agencies involved, was set up, and responsibility for implementation was centralized within the government’s digital service, now called Logius.23

Within two years nearly 100,000 annual regulatory filings – primarily tax and financial disclosures – were being submitted by companies to regulatory agencies using the taxonomy.

However, “[t]he government agencies understood that complete adoption by the market and the step to proper service management could not be realised if SBR remained a voluntary solution for business reporting.”24 Market participants acknowledged this as well.25 Accordingly, in June 2011, the Tax and Customs Administration agreed to make the taxonomy semi-mandatory26 for tax declarations by 2014.27 Tax declarations submitted directly from software packages were required to be encoded in the Netherlands Taxonomy. Companies could still manually submit tax declarations using a Tax & Customs Administration web portal that automatically converted the information into the taxonomy.

In 2012, the Chamber of Commerce, which collects Dutch corporate financial disclosures, began to discourage companies from submitting financial statements in PDF and encourage them to submit financial statements using the taxonomy.28 In November 2015, the Dutch parliament enacted legislation to make financial reporting via the Netherlands Taxonomy semi-mandatory, in the same manner used for tax declarations, for smaller companies in 2017, medium-sized companies in 2017, and larger companies in 2019.29

Beyond the domains of tax and corporate finance reporting, the Netherlands Taxonomy has been extended to cover additional regulatory reporting regimes. On September 8, 2015, Standard Business Commissioner Rob Kuipers laid out a vision for “business reporting in zero clicks”: the idea that all regulatory reporting should be automatic, with information automatically culled from companies’ software.30

The Netherlands Taxonomy has also been embraced beyond the regulatory sector for some business-to-business reporting practices. On January 1, 2017, the country’s three largest banks finished converting their commercial credit reporting regimes to the Netherlands Taxonomy.31

The creation and development of the Netherlands Taxonomy is a model of the first and second steps of SBR, as defined by the OECD. “In the first stage of taxonomy development 200,000 reporting data items were identified. After thorough analysis the number was reduced to 8,000 unique data items.”32 The number of unique data elements has been further reduced to approximately 4,500 through legislative reforms.33

The Dutch government has figuratively and literally written the book on SBR. Challenging the Chain: Governing the Automated Exchange and Processing of Business Information, which describes the history, challenges and approaches of the SBR program, is freely available online.34 The ‘chain’ of the title is an information chain – a collection of links of information connecting suppliers (such as regulated companies) and users (including regulatory agencies and other users). Each link represents an action on the data that contributes to the value of the process or deliverable, thus establishing a flow. Information chains are the specific focus of Challenging the Chain. The book provides a simple example of the concept:

When considering the production of a consumer good, such as a television, activities could involve its assemblage, production, inspection, packaging, transport and storage. These kinds of activities require inputs - human resources and raw materials - which are employed to add value and transport the flow elements to the next actor (or stage) in the chain.35

It is easy to imagine the information chains related to regulatory reporting processes. Regulated entities accumulate, validate, and report prescribed information to regulatory agencies, who then consume the information for analysis, enforcement, and oversight, and sometimes make it available to the public.

By envisioning all of its regulatory reporting requirements as information chains, the Dutch government was able to develop a holistic view of its regulatory environment that is not dependent on any particular domain (tax, corporate finance, statistics, etc.).

Thanks to the Dutch SBR program, Dutch companies enjoy both benefits identified in the introduction to this paper. First, their software uses the Netherlands Taxonomy to automatically compile and submit tax declarations, financial statements, and other regulatory filings. This saves time and money over manually preparing disclosure documents. Second, the taxonomy’s reduction in data elements from hundreds of thousands to just a few thousand allows companies to invest time and money just once to comply with multiple agencies’ requirements.

Meanwhile, by eliminating documents and PDFs from their intake, and replacing document-based reporting with open data, regulatory agencies in the Netherlands have gained the ability to deploy analytics without any translation.

Other stakeholders in the Netherlands recognized the value of open, electronically standardized data and have begun implementing the Netherlands Taxonomy for other purposes. For instance, ING Bank has reduced fees for small and medium companies, together with other benefits, if their financing applications include SBR-enabled digital financial information.36

Standard Business Reporting in Australia

On October 12, 2005, Prime Minister John Howard’s Australian government appointed a task force “to identify practical options for alleviating the compliance burden on business from Government regulation.”37 The task force’s resulting report,38 issued on January 31, 2006, recommended that the government review all the “data collection and regulatory reporting obligations” imposed by its financial and economic agencies, with a view toward eliminating overlaps, and “establish an integrated data collection portal to ensure that regulated entities have to provide information only once.”39

To implement this recommendation, the Australian government established a Standard Business Reporting program in 2008, involving both federal and state/territorial agencies, with the Australian Taxation Office (ATO) serving as the lead agency. While the initiative was ultimately projected to involve the “whole-of-government,” consideration was given in the initial stages to the inclusion of two groups of agencies: the “General Ledger” cluster, which receive taxation, financial and company reports from businesses, and the “Trade” cluster, which receive customs and international trade reports.

Initially, the SBR program’s leadership focused only on the “General Ledger” cluster of agencies. Following the publication of the first version of the Standard Business Reporting Australia Taxonomy in 2010,40 the ATO, the Australian Securities & Investments Commission (ASIC), and the revenue offices of Australian states and territories began accepting filings using the taxonomy.41 The Australian Prudential Regulation Authority, which regulates banks, retirement funds, credit unions, and other financial entities, began accepting SBR filings the following year.42 The Australian Bureau of Statistics also participated in the program through the development of the taxonomy.

The number of software developers with SBR-enabled commercial software products fit for purpose and ready or available to be used by Australian companies steadily increased to 54 by mid-2014, covering 515 reporting obligations to the “General Ledger” agencies.43 By this time, a further 115 developers were licensed to develop SBR-enabled software for businesses to compile and submit reports using the taxonomy.44

The Australian SBR program has differed from the Netherlands’ program in that, with the sole exception of superannuation (retirement fund) transactions, which arose from a request by the industry, the use of SBR has not yet been mandated.

Like in the Netherlands, the Australian SBR program has begun to spread to business-to-business, as well as business-to-government, reporting. A pilot effort at the Australian Business Register (somewhat equivalent to U.S. corporate registers, which operate on the state, rather than federal, level) is aimed at standardizing electronic invoices issued by companies to one another, using new data elements in the same taxonomy.45

Also paralleling the Dutch experience, the creation of the Australian taxonomy reduced the number of data elements Australian companies report to the participating regulatory agencies. By 2014, “implementing the taxonomy … reduced the number of unique reporting terms used across the forms that [were] accessible through SBR from almost 35,000 to less than 7,000 unique terms, a reduction of more than 80%.”46

To assist in expanding the scope of SBR to a wider “whole-of-government” context, the program’s leadership decided in 2015 to support a limited number of data formats, in addition to XBRL (eXtensible Business Reporting Language), which had been used since the program’s launch. The decision to broaden SBR’s capabilities was made to support the implementation of different patterns of digital interaction in additional sectors of reporting to government.

“We stood on the shoulders of the Dutch efforts,” says John McAlister, the Assistant Commissioner, Stakeholder Engagement and Adoption (ABR and SBR), at the Australian Business Register.48 The results, as gathered from various Australian government sources, speak for themselves. In 2014-15, some AUS $400 million in compliance savings were recorded in Australia due to SBR across two spheres: business-to-business, and business-to-government.49 An ATO/Deloitte report estimated savings of AUS $1.1 billion for 2015-16; these savings are projected to increase substantially in future years as the SBR program further expands.50

Australian companies are reaping the same benefits as Dutch ones: automated reporting and reduced regulatory overlap. The Australian government benefits in the same way as its Dutch role model: standardized filings facilitate analytics.

Standard Business Reporting in the United States

Despite the early success of SBR in the Netherlands and Australia, and efforts underway in other countries,51 the concept is nearly unknown in the United States.52 Admittedly, the U.S.’ regulatory landscape is more complicated than the Netherlands’ or Australia’s, its economy many times larger, and compliance costs correspondingly enormous. A U.S. SBR program would face greater challenges than its Dutch and Australian predecessors – but could also expect to generate even greater savings for the private sector and government.

On several occasions, the U.S. private sector has tried to build open data taxonomies to standardize regulatory information.

In March 2006, Stanford Law School’s Rock Center for Corporate Governance announced the creation of the Open Source Corporate Governance Reporting System, a database of publicly-traded companies’ corporate-governance data, which would “enable users to develop their own research and analytics.”53

In May 2009, the Depository Trust & Clearing Corporation, which manages clearing services for most U.S. financial products, and the standards organizations SWIFT and XBRL US announced54 that it would build an open data taxonomy to express corporate actions, such as the issuance of dividends, rights offerings, and mergers. The taxonomy was completed in 2011 and updated in 2012, but is not in use.55

In June 2016, State Street Bank completed the first successful pilot test of the Financial Industry Business Ontology (FIBO), which standardizes financial-industry concepts.56 FIBO has been in development by the Enterprise Data Management Council since 2011, but is not used in production systems or in official regulatory reporting.

None of these efforts has achieved market-wide savings in regulated entities’ compliance costs. Nor have any, more broadly, made information acquisition more efficient for the industries in which they operate.

Since regulatory reporting requirements are driven by government, it makes sense that that any SBR initiative must be also led by government. This is not any easy task, given the cultural and political hurdles facing any change to regulatory practice. Nonetheless, there are significant economic benefits to be gained, along with the promise of better, more timely information.

How would the US Government start down an SBR path, pursuing the four steps identified by the OECD? First, which U.S. government entity is best positioned to create a national taxonomy?

The United States is a constitutional republic rather than a parliamentary democracy like the Netherlands and Australia, with separate legislative and executive branches. A U.S. government-wide taxonomy creation project would need a formal, legal mandate from Congress – and preferably informal support from both Congress and the White House – in order to move forward across multiple regulatory sectors.

In both the Netherlands and Australia, tax reporting is a centerpiece of SBR, and tax agencies have played a key role in taxonomy creation. But the U.S. Internal Revenue Service has characteristics that quite distinguish it from its Dutch and Australian counterparts: an institutional and statutory reluctance to share data and a cultural aloofness from other regulators. Likewise, there are also very strong traditions of independence associated with U.S. banking and securities regulators.

Several existing entities and projects within the U.S. federal government have government-wide regulatory or data-related roles. Under the DATA Act of 2014, the Treasury Department has promulgated a government-wide taxonomy for U.S. federal spending information. The White House Office of Management and Budget’s Office of Information and Regulatory Affairs (OIRA) reviews government information collections under the Paperwork Reduction Act;57 the Financial Stability Oversight Council (FSOC) oversees all financial regulatory reporting, as mandated by the Dodd-Frank financial reform;58 and the National Information Exchange Model is the only government-wide, multi-domain data standardization project.59 However, none of these are currently capable of launching or sustaining a U.S. SBR program. The DATA Act mandate applies to spending information, not regulatory reports. OIRA focuses on document-based forms, not data, and its authority over independent, non-Cabinet agencies is limited; the FSOC’s membership is restricted to financial regulatory agencies; and NIEM’s expansion is voluntary, not mandatory.

Since no U.S. government entity currently has the authority to create and impose an SBR taxonomy, a full-scale SBR program cannot begin without a legislative reform, enacted by Congress, that either creates and empowers a new entity or else invests an existing one with new powers. Moreover, even with a legal mandate from Congress, such a complex project probably would still fail without enthusiastic support from the ‘bully pulpit’ of the Presidency.

While the idea of central authority is important, it may be equally important to not assume that there will be just one SBR taxonomy, at least not initially. For example, the FSOC already has the authority to create and impose a taxonomy within the financial regulatory sector.

Second, how could a U.S. SBR taxonomy be wielded to consolidate duplicative requirements? The entity leading a U.S. SBR program must be assigned to investigate, and publish reports on, duplication across regulatory agencies’ reporting regimes revealed by the taxonomy. Agencies’ own constituencies – whether securities or retirement or tax – must be encouraged to advocate for those agencies to change local rules and reporting practices to eliminate duplication. Without a powerful mandate for consolidation, domain-specific and agency-specific idiosyncrasies will rule the day.

Third, how could companies be required, or at least strongly encouraged, to file reports using a U.S. SBR taxonomy? Each agency participating in a U.S. SBR program could direct its regulated entities to do so – but a stronger centralized mandate might be required. Perhaps Congress should amend regulatory agencies’ governing laws to require each agency to direct its regulated entities to submit regulatory information using the SBR taxonomy.

Moving regulated entities to report under the SBR taxonomy is critical to step four in the OCED recommendations, i.e., having available the necessary tools for the compilation and submission of SBR reports, and for the analysis of standardized SBR data. The technology industry will not invest in creating the necessary tools without the expectation of a market, andphased-in mandatory reporting would provide such notice. Moreover, a U.S. SBR program cannot expect significant benefits without involving software providers, a lesson learned from the Dutch and Australian SBR experiences.

John Truzzolino, Director, Business Development for Global Capital Markets at RR Donnelley reinforced this necessity. “Through this process what is really the big differentiator ... what is challenging in the US ... [is that] the international markets are more open to presenting a true consortium of public and private stakeholders working in concert on a common objective. The Dutch program involved a covenant of cooperation [between government and industry].”60

Finally, are the U.S. government and private sector ready to embrace the challenge of SBR? One might assume that the immediate answer is ‘YES!’, especially considering the chaos and expense of the current regulatory compliance landscape, and recent related moves by the U.S. Congress and executive branch. But as noted earlier, agencies are slow to embrace change, especially change which suggests more transparency and better oversight. These are powerful agencies with powerful constituencies, both rich in tradition and culture, and to embrace this sort of change will require extraordinary leadership and vision.

One way to test the appetite for SBR is to track current related legislation. The U.S Congress is considering the Financial Transparency Act,61 which, if enacted as written currently, would require the eight major U.S. financial regulatory agencies to adopt standardized data fields and formats for the information they collect from public companies, banks, and financial firms. The Financial Transparency Act, if enacted, could have the effect of establishing a more modest version of SBR, limited to financial regulatory compliance regimes.

The U.S. government has embraced data standardization for its own internal financial reporting. Under the Digital Accountability and Transparency Act (DATA Act) of 2014,62 by May 2017 every federal agency must begin reporting its spending using a standardized taxonomy created by the Treasury Department.

If the United States embraces SBR, we can expect benefits similar to those enjoyed already in the Netherlands and Australia. Companies will be able to automate the compilation and submission of their regulatory reports – and enjoy additional cost reduction from the ability to reuse efforts from one regulatory regime to another. Regulatory agencies will benefit from access to a standardized data source covering multiple regimes – a foundation for instant analytics to illuminate violations, errors, and fraud.

The Future of Standard Business Reporting

Assuming, for the moment, that the United States initiates and executes an SBR program along similar lines to the pioneering ones of the Netherlands and Australia, the first beneficiaries, as described above, will be regulated companies and regulatory agencies.

As Danny Kermode puts it, “I think everyone agrees interactive data is the future, they just don’t understand how to get there.”63 Mr. Kermode is the Assistant Director of Water & Transportation for the Washington Utilities and Transportation Commission (UTC), and initiated a pilot program to adopt a standardized taxonomy for utilities’ financial reports. The UTC had been collecting financial reports in multiple formats, requiring both a PDF file and also the native format (Word, Excel, etc.) that produced the file, but it realized advantages from adopting the eXtensible Business Reporting Language (XBRL) format, which expresses the arithmetic relationships between data fields.

“I see the benefits for regulators as enormous,” said Kermode. “Recognizing that we have a lot of highly skilled professionals who spend a tremendous amount of time doing classic transcription[, standardized reporting] will allow these individuals to focus on analysis and spend time understanding the data, rather than transcribing.” At the same time, he noted that companies would be able to communicate the data internally to any element of their company using the same setup and technology.

Aside from regulatory agencies and regulated companies, who else benefits? Information Week recently reported that IDC forecasts a 50% uptick in the sale of big data and business analytics software, hardware and services by 2019, with sales reaching $187 billion.64 To the extent that SBR delivers an open data set covering information reported to multiple regulators, SBR will create new opportunities for:

FINANCIAL TECHNOLOGY FIRMS - whether their goal is to work in concert with existing financial services firms or to disrupt them. As Kevin Roose wrote in New York magazine, “Undercutting big banks and speeding up processes might not be as sexy as, say, creating the next Snapchat, but it’s low-hanging fruit for techies who want a way in to a lucrative market. After all, today’s megabanks are really just bundles of particular, loosely related services cobbled together by years of acquisitions and market-consolidation. If those bundles can be broken apart, the start-up world’s revolution looks a lot more plausible.”65

EXISTING FINANCIAL FIRMS, like Citigroup, Wells Fargo, BBVA and others, who have made a point of increasing their focus on venture funding and acquisition of firms like the ones above, or who have or are developing massive internal engines to handle transaction data, portfolio and/or risk management and even client services (institutional or otherwise), in such a way that they will have access to proprietary big data that can drive major strategic initiatives.

THIRD-PARTY SOFTWARE AND SERVICE VENDORS, ranging from tax firms and auditors to compliance outsourcing or consulting firms such as 8of9 or RIA in a Box, all of which are accustomed to helping clients navigate through unfamiliar process and technology as an element of their business model.

MARKET DATA FIRMS, who will no doubt be keeping a close eye on how new technologies - and the availability of extensive troves of public financial data - might affect them in the future, and who have the existing technology, expertise and branding to be associated with data as new models emerge.

SBR creates efficient, trusted, open data ecosystems – or information chains - involving regulatory agencies, regulated entities, and other organizations. Once standardized and trustworthy, these ecosystems (or chains) do not only serve existing stakeholders, but also contribute to the further generation of innovative information products and services.

SBR is no longer new. The necessary technologies and governance structures have been tested and refined by the Dutch and Australian programs. All that is needed in the United States is the will to seize this opportunity. To realize savings for regulated companies and the regulators themselves, and to enable new growth in financial technology and market data, Congress and the executive branch must act.

REFERENCES

1. National Association of Manufacturers, The Cost of Federal Regulation to the U.S. Economy, Manufacturing and Small Business, September 10, 2014, available at http://www.nam.org/Data-and-Reports/Reports/Cost-of-Federal-Regulations/The-Cost-of-Federal-Regulation/.

2. Id. at 22.

3. U.S. Securities and Exchange Commission, FY 2017 Congressional Budget Justification, available at www.sec.gov/about/reports/secfy17congbudgjust.pdf, at 16.

4. Board of Governors of the Federal Reserve System, Annual Report 2015, available at www.federalreserve.gov/publications/annual-report/2015-federal-reserve-system-budgets.htm-xboardofgovernorsbudgets-f2c579a2, at Table 3.

5. Internal Revenue Service, FY 2017 President’s Budget, available at www.treasury.gov/about/budget-performance/CJ17/02-06.%20IRS%20FY%202017%20CJ%201%2022%2016%20v2%20FINAL%20CLEAN.PDF, at Table 1.1.

6. U.S. Census Bureau, FY 2016 Budget Estimates, available at www.osec.doc.gov/bmi/budget/FY16CJ/Census_2016_CJ.pdf, at 24 ($65 million for “General economic statistics”).

7. XBRL US, Better Data for Better Decisions: Standards to Improve Corporate Government Reporting, October 2011, available at xbrl.us/wp-content/uploads/2011/12/BetterReporting.pdf, at 10 (reporting that a majority of data fields reported to the Bureau of Economic Analysis by a large public company were already reported to the Securities and Exchange Commission; the same was true for a substantial proportion of data fields reported to the Census Bureau; and Federal Reserve reports were entirely duplicative of SEC reports).

8. Peter van den Hul, Financial Data Standardisation Project, 22nf Eurofiling Workshop, June 2, 2016, available at http://eurofiling.info/201606/Presentations/2016-06-02%2015h00%20FDS%20Project%20Presentation.pdf.

9. Alison Gill, Adam Hughes, and Hudson Hollister, The State of the Union of Open Data, November 2016, available at www.datafoundation.org/state-of-the-union-of-open-data-2016/.

10. See Randy Hultgren, “How to Stop the Next Bernie Madoff,” The Guardian, August 16, 2016, available at www.theguardian.com/commentisfree/2016/aug/16/how-to-stop-the-next-bernie-madoff.

11. See Dick Berner, Remarks by OFR Director Dick Berner at the Financial Regulation Summit: Data Transparency Transformation, March 24, 2015, available at https://www.financialresearch.gov/public-appearances/2015/03/24/financial-regulation-summit/.

12. Several other SBR implementations are under way, not covered in detail by this paper. In Finland, Vero Skatt – the Finnish Tax Service – introduced in 2016 joint filings with the National Board of Patents and Registration. See “Tilinpäätös 2.0 ensimmäisten käyttöön syyskuussa 2016,” June 21, 2016, available at https://www.vero.fi/fi-FI/Tietoa_Verohallinnosta/Uutiset/Tilinpaatos_20_ensimmaisten_kayttoon_syy(40033). Authorities in Sweden embarked in 2016 on a project coordinated by the Swedish Business Register – Bolagsverket – that aims to introduce Standard Business Reporting across several government organizations, including Statistics Sweden, the Swedish Financial Stability Authority, and others. See “Information days about digital filing of annual reports,” Bolagsverket, November 28-29, 2016, available at http://www.bolagsverket.se/polopoly_fs/1.13824!/bolagsverkets-presentation.pdf. In 2015, South African regulators jointly developed a governance framework and nationwide standard to guide all relevant regulators in the consistent implementation of open data. The framework has already been applied in practice by the South African business register. See “XBRL South Africa Standard,” Companies and Intellectual Property Commission, 2015, available at http://www.cipc.co.za/files/3414/3221/4863/BR-AG_XBRL_SA_Standard_Architecture_Document_-_PUBLIC_DRAFT_V1_01.pdf.

13. See Paris Cowan, “Tax office claims $1 billion in savings from SBR,” ITNews, August 3, 2016, available at www.itnews.com.au/news/tax-office-claims-1-billion-in-savings-from-sbr-432460.

14. Organisation for Economic Co-operation and Development, Forum on Tax Administration: Taxpayer Services Sub-Group, Guidance Note: Standard Business Reporting, July 2009, available at www.oecd.org/tax/forum-on-tax-administration/publications-and-products/admin/43384923.pdf (“OECD Paper”), at 9.

15. See, e.g., Data Coalition, “Coalition to SEC: Replace Corporate Disclosure Documents with Open Data,” July 22, 2016, www.datacoalition.org/coalition-to-sec-replace-corporate-disclosure-documents-with-open-data/ (describing SEC’s persistent use of unstructured documents to collect disclosures from publicly-listed companies).

16. OECD Paper at 9.

17. Logius & Thauris, Challenging the Chain, March 2015, available at challengingthechain.com, at 381.

18. Id. at Appendix A.

19. Id.

20. Id.

21. Id. at XVIII.

22. Interview with Frans Hietbrink.

23. Challenging the Chain at Appendix A.

24. Id.

25. Interview with Frans Hietbrink.

26. “The use of SBR would only be mandatory for declarations that reporting parties (businesses or their intermediaries) sent in directly from software packages, thus system-to-system. For that reason, this step is referred to as ‘mandating’ the use of SBR. Alternatives, such as submitting reports via a portal on the Tax and Customs Administration website, will nevertheless continue to exist.” Challenging the Chain at Appendix A.

27. Id.

28. Id.

29. Ministerie van Economische Zaken, January 2017, available at https://www.kvk.nl/download/QA_deponeren_jaarstukken_jan2017_tcm109-431972.pdf (in Dutch). See also XBRL International, “New Mandate in the Netherlands,” November 29, 2015, www.xbrl.org/news/new-mandate-in-the-netherlands/.

30. See Data Coalition, “Dutch Government Envisions Business Reporting in Zero Clicks,” December 10, 2015, www.datacoalition.org/dutch-government-envisions-business-reporting-in-zero-clicks/.

31. See XBRL International, “SBR Expands to Credit Reporting in the Netherlands,” February 12, 2015, www.xbrl.org/news/sbr-expands-to-credit-reporting-in-the-netherlands/.

32. Fujitsu, SBR Programmes: Reducing administrative burden through countrywide standardisation, October 2016, available at www.fujitsu.com/global/documents/products/software/middleware/application-infrastructure/interstage/download/xbrl/FUJITSU-SBR-Programmes.pdf.

33. Id.

34. Challenging the Chain.

35. Id. at 40.

36. “Digitaal aanleveren jaarcijfers MKB ook bij ING de norm,” ING, October 2014, available at https://www.ing.nl/nieuws/nieuws_en_persberichten/2014/10/Digitaal_aanleveren_jaarcijfers_mkb_ook_bij_ing_de_norm.html.

37. Australian Government, Rethinking Regulation: Report of the Task Force on Reducing Regulatory Burdens on Business: Australian Government’s Response, 2006, available at archive.treasury.gov.au/documents/1141/PDF/Reducing_Regulatory_Burdens_on_Business_Final_Government_Response.pdf, at i.

38. Id.

39. Id. at Recommendation 5.11.

40. Australian Government, Australian Reporting Dictionary, available at dictionary.sbr.gov.au/ (accessed February 8, 2017).

41. Australian Prudential Regulatory Authority, Adopting Standard Business Reporting: A Guide to Adopting SBR for APRA Reporting, August 2011, available at http://www.apra.gov.au/Super/Documents/AdoptingSBRforAPRA reporting.pdf, at 1.

42. Id.

43. Australian Government, Standard Business Reporting Four Years On, June 2014 (“Four Years On”). One key aspect of Australian SBR that goes beyond regulatory reporting is a functionality for private employers and retirement funds to use the SBR system to automatically check an employee’s details against official tax details maintained by the Australian Tax Office. Id. at 3.

44. Id. at 9.

45. Australian Government, SBR Board Meeting Item 4.0, April 8, 2016, at 4.

46. Four Years On at 6.

47. Interview with Karen Lay-Brew.

48. Interview with John McAlister.

49. Australian Government, Report of the Australian Business Registrar, 2014-15 (“ABR Report), available at abr.gov.au/uploadedFiles/Content/Download_Files/ABRreport2014-15.pdf, at 3.

50. Australian Taxation Office and Deloitte, ABR Program Savings Review (“Deloitte Report”), March 24, 2016, at 26.

51. See, e.g., XBRL International, “Sweden Looks to SBR,” June 3, 2016, www.xbrl.org/sweden-looks-to-sbr/.

52. The most prominent endorsement of U.S. SBR can be found in the Center for Data Innovation’s 2016 presidential transition report. Center for Open Data Enterprise, Open Data Transition Report: An Action Plan for the Next Administration, October 2016, available at http://reports.opendataenterprise.org/transition-report.pdf, at recommendation 24.

53. Barry Burr, “Stanford Center’s New Database,” March 20, 2006, Pensions & Investments, www.pionline.com/article/20060320/PRINT/603200720/stanford-centerx2019s-new-database.

54. XBRL US, “DTCC, SWIFT and XBRL US Join Together on Plan to Improve Processing of Corporate Actions Announcements,” May 28, 2009, www.prnewswire.com/news-releases/dtcc-swift-and-xbrl-us-join-together-on-plan-to-improve-processing-of-corporate-actions-announcements-62005092.html.

55. See XBRL US, “Corporate Actions,” xbrl.us/home/industries/corporate-actions/ (accessed February 8, 2017).

56. Emilia David, “FIBO Marches Forward: A Look Inside State Street's FIBO Proof of Concept,” June 3, 2016, Waters Technology, www.waterstechnology.com/waters/feature/2459451/fibo-marches-forward-a-look-inside-state-streets-fibo-proof-of-concept.

57. 44 U.S.C. 35.

58. Public L. No. 111-203, Title I.

59. See NIEM.gov (accessed February 28, 2017).

60. Interview with John Truzzolino.

61. H.R. 2477 (114th Congress).

62. Pub. L. No. 113-111.

63. Interview with Danny Kermode.

64. Jessica Davis, “Big Data, Analytics Sales Will Reach $187 Billion By 2019,” May 24, 2016, Information Week, www.informationweek.com/big-data/big-data-analytics/big-data-analytics-sales-will-reach-$187-billion-by-2019/d/d-id/1325631.

65. Kevin Roose, “Is Silicon Valley the Future of Finance?,” June 1, 2014, New York, nymag.com/daily/intelligencer/2014/05/is-silicon-valley-the-future-of-finance.html.

National Association of Manufacturers, The Cost of Federal Regulation to the U.S. Economy, Manufacturing and Small Business, September 10, 2014. ↩

Id. at 22. ↩

U.S. Securities and Exchange Commission, FY 2017 Congressional Budget Justification, at 16. ↩

Board of Governors of the Federal Reserve System, Annual Report 2015, at Table 3. ↩

Internal Revenue Service, FY 2017 President’s Budget, at Table 1.1. ↩

U.S. Census Bureau, FY 2016 Budget Estimates, at 24 ($65 million for “General economic statistics”). ↩

XBRL US, Better Data for Better Decisions: Standards to Improve Corporate Government Reporting, October 2011, at 10 (reporting that a majority of data fields reported to the Bureau of Economic Analysis by a large public company were already reported to the Securities and Exchange Commission; the same was true for a substantial proportion of data fields reported to the Census Bureau; and Federal Reserve reports were entirely duplicative of SEC reports). ↩

Peter van den Hul, Financial Data Standardisation Project, 22nf Eurofiling Workshop, June 2, 2016. ↩

Alison Gill, Adam Hughes, and Hudson Hollister, The State of the Union of Open Data, November 2016. ↩

See Randy Hultgren, “How to Stop the Next Bernie Madoff,” The Guardian, August 16, 2016. ↩

See Dick Berner, Remarks by OFR Director Dick Berner at the Financial Regulation Summit: Data Transparency Transformation, March 24, 2015. ↩

Several other SBR implementations are under way, not covered in detail by this paper. In Finland, Vero Skatt – the Finnish Tax Service – introduced in 2016 joint filings with the National Board of Patents and Registration. See “Tilinpäätös 2.0 ensimmäisten käyttöön syyskuussa 2016,” June 21, 2016. Authorities in Sweden embarked in 2016 on a project coordinated by the Swedish Business Register – Bolagsverket – that aims to introduce Standard Business Reporting across several government organizations, including Statistics Sweden, the Swedish Financial Stability Authority, and others. See “Information days about digital filing of annual reports,” Bolagsverket, November 28-29, 2016. In 2015, South African regulators jointly developed a governance framework and nationwide standard to guide all relevant regulators in the consistent implementation of open data. The framework has already been applied in practice by the South African business register. See “XBRL South Africa Standard,” Companies and Intellectual Property Commission, 2015. ↩

See Paris Cowan, “Tax office claims $1 billion in savings from SBR,” ITNews, August 3, 2016. ↩

Organisation for Economic Co-operation and Development, Forum on Tax Administration: Taxpayer Services Sub-Group, Guidance Note: Standard Business Reporting, July 2009, at 9. ↩

See, e.g., Data Coalition, “Coalition to SEC: Replace Corporate Disclosure Documents with Open Data,” July 22, 2016, (describing SEC’s persistent use of unstructured documents to collect disclosures from publicly-listed companies). ↩

OECD Paper at 9. ↩

Logius & Thauris, Challenging the Chain, March 2015. ↩

Id. at Appendix A. ↩

Id. ↩

Id. ↩

Id. at XVIII. ↩

Challenging the Chain at Appendix A. ↩

Id. ↩

Interview with Frans Hietbrink. ↩

“The use of SBR would only be mandatory for declarations that reporting parties (businesses or their intermediaries) sent in directly from software packages, thus system-to-system. For that reason, this step is referred to as ‘mandating’ the use of SBR. Alternatives, such as submitting reports via a portal on the Tax and Customs Administration website, will nevertheless continue to exist.” Challenging the Chain at Appendix A. ↩

Id. ↩

Id. ↩

Ministerie van Economische Zaken, January 2017, in Dutch. See also XBRL International, “New Mandate in the Netherlands,” November 29, 2015. ↩

See Data Coalition, “Dutch Government Envisions Business Reporting in Zero Clicks,” December 10, 2015. ↩

See XBRL International, “SBR Expands to Credit Reporting in the Netherlands,” February 12, 2015. ↩

Fujitsu, SBR Programmes: Reducing administrative burden through countrywide standardisation, October 2016. ↩

Id. ↩

Challenging the Chain. ↩

Id. at 40. ↩

“Digitaal aanleveren jaarcijfers MKB ook bij ING de norm,” ING, October 2014. ↩

Australian Government, Rethinking Regulation: Report of the Task Force on Reducing Regulatory Burdens on Business: Australian Government’s Response, 2006, at i. ↩

Id. ↩

Id. at Recommendation 5.11. ↩

Australian Government, Australian Reporting Dictionary (accessed February 8, 2017). ↩

Australian Prudential Regulatory Authority, Adopting Standard Business Reporting: A Guide to Adopting SBR for APRA Reporting, at 1. ↩

Id. ↩

Australian Government, Standard Business Reporting Four Years On, June 2014 (“Four Years On”). One key aspect of Australian SBR that goes beyond regulatory reporting is a functionality for private employers and retirement funds to use the SBR system to automatically check an employee’s details against official tax details maintained by the Australian Tax Office. Id. at 3. ↩

Id. at 9. ↩

Australian Government, SBR Board Meeting Item 4.0, April 8, 2016, at 4. ↩

Four Years On at 6. ↩

Interview with John McAlister. ↩

Australian Government, Report of the Australian Business Registrar, 2014-15 (“ABR Report), at 3. ↩

Australian Taxation Office and Deloitte, ABR Program Savings Review (“Deloitte Report”), March 24, 2016, at 26. ↩

See, e.g., XBRL International, “Sweden Looks to SBR,” June 3, 2016. ↩

The most prominent endorsement of U.S. SBR can be found in the Center for Data Innovation’s 2016 presidential transition report. Center for Open Data Enterprise, Open Data Transition Report: An Action Plan for the Next Administration, October 2016, at recommendation 24. ↩

Barry Burr, “Stanford Center’s New Database,” March 20, 2006, Pensions & Investments. ↩

XBRL US, “DTCC, SWIFT and XBRL US Join Together on Plan to Improve Processing of Corporate Actions Announcements,” May 28, 2009. ↩

See XBRL US, “Corporate Actions,” (accessed February 8, 2017). ↩

Emilia David, “FIBO Marches Forward: A Look Inside State Street's FIBO Proof of Concept,” June 3, 2016, Waters Technology. ↩

44 U.S.C. 35. ↩

Public L. No. 111-203, Title I. ↩

See NIEM.gov (accessed February 28, 2017). ↩

Interview with John Truzzolino. ↩

H.R. 2477 (114th Congress). ↩

Pub. L. No. 113-111. ↩

Interview with Danny Kermode. ↩

Jessica Davis, “Big Data, Analytics Sales Will Reach $187 Billion By 2019,” May 24, 2016, Information Week. ↩

Kevin Roose, “Is Silicon Valley the Future of Finance?,” June 1, 2014, New York. ↩